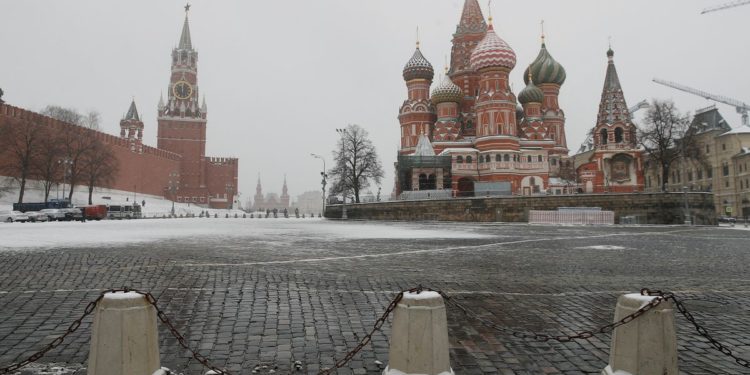

The clock on Spasskaya tower displaying the time at midday, is pictured subsequent to Moscow?s Kremlin, and St. Basil?s Cathedral, March 31, 2020. REUTERS/Maxim Shemetov

Register now for FREE limitless entry to Reuters.com

LONDON, June 26 (Reuters) – Russia edged nearer to default on Sunday amid little signal that traders holding its worldwide bonds had obtained fee, heralding what can be the nation’s first default in a long time.

Russia has struggled to maintain up funds on $40 billion of excellent bonds since its invasion of Ukraine on Feb. 24, which provoked sweeping sanctions which have successfully reduce the nation out of the worldwide monetary system and rendered its property untouchable to many traders.

The Kremlin has repeatedly stated there are not any grounds for Russia to default however is unable to ship cash to bondholders due to sanctions, accusing the West of attempting to drive it into a synthetic default.

Register now for FREE limitless entry to Reuters.com

The nation’s efforts to swerve what can be its first main default on worldwide bonds for the reason that Bolshevik revolution greater than a century in the past hit an insurmountable roadblock when the U.S. Treasury Division’s Workplace of International Belongings Management (OFAC) successfully blocked Moscow from making funds in late Might.

“Since March we thought {that a} Russian default might be inevitable, and the query was simply when,” Dennis Hranitzky, head of sovereign litigation at legislation agency Quinn Emanuel, informed Reuters. “OFAC has intervened to reply that query for us, and the default is now upon us.”

Whiel a proper default can be largely symbolic given Russia can’t borrow internationally in the mean time and would not have to due to wealthy oil and fuel income, the stigma would in all probability elevate its borrowing prices in future.

The funds in query are $100 million in curiosity on two bonds, one denominated in U.S. {dollars} and one other in euros , Russia was on account of pay on Might 27. The funds had a grace interval of 30 days, which is able to expire on Sunday.

Russia’s finance ministry stated it made the funds to its onshore Nationwide Settlement Depository (NSD) in euros and {dollars}, including it has fulfilled obligations.

Nevertheless, it’s unlikely that funds will discover their method to many worldwide holders. For a lot of bondholders, not receiving the cash owed in time into their accounts constitutes a default.

With no precise deadline specified within the prospectus, attorneys say Russia might need till the tip of the next enterprise day to pay the bondholders.

SMALL PRINT

The authorized state of affairs surrounding the bonds appears to be like advanced.

Russia’s bonds have been issued with an uncommon number of phrases, and an growing stage of ambiguities for these bought extra not too long ago, when Moscow was already going through sanctions over its annexation of Crimea in 2014 and a poisoning incident in Britain in 2018.

Rodrigo Olivares-Caminal, chair in banking and finance legislation at Queen Mary College in London, stated readability was wanted on what constituted a discharge for Russia on its obligation, or the distinction between receiving and recovering funds.

“All these points are topic to interpretation by a courtroom of legislation, however Russia has not waived any of its sovereign immunity and has not submitted to the jurisdiction of any courtroom in any of the 2 prospectuses,” Olivares-Caminal informed Reuters.

In some methods, Russia is in default already.

A committee on derivatives has dominated a “credit score occasion” had occurred on a few of its securities, which triggered a payout on a few of Russia’s credit score default swaps – devices utilized by traders to insure publicity to debt towards default. This was triggered by Russia failing to make a $1.9 million fee in accrued curiosity on a fee that had been due in early April. learn extra

Till the Ukraine invasion, a sovereign default had appeared unthinkable, with Russia being rated funding grade as much as shortly earlier than that time. A default would even be uncommon as Moscow has the funds to service its debt.

The OFAC had issued a brief waiver, often known as a normal licence 9A, in early March to permit Moscow to maintain paying traders. It let it expire on Might 25 as Washington tightened sanctions on Russia, successfully reducing off funds to U.S. traders and entities.

The lapsed OFAC licence isn’t the one impediment Russia faces as in early June the European Union imposed sanctions on the NSD, Russia’s appointed agent for its Eurobonds. learn extra

Moscow has scrambled in latest days to search out methods of coping with upcoming funds and keep away from a default.

President Vladimir Putin signed a decree final Wednesday to launch non permanent procedures and provides the federal government 10 days to decide on banks to deal with funds below a brand new scheme, suggesting Russia will contemplate its debt obligations fulfilled when it pays bondholders in roubles.

“Russia saying it is complying with obligations below the phrases of the bond isn’t the entire story,” Zia Ullah, companion and head of company crime and investigations at legislation agency Eversheds Sutherland informed Reuters.

“When you as an investor usually are not happy, as an illustration, if you recognize the cash is caught in an escrow account, which successfully can be the sensible impression of what Russia is saying, the reply can be, till you discharge the duty, you haven’t happy the situations of the bond.”

Register now for FREE limitless entry to Reuters.com

Reporting by Karin Strohecker; Further reporting by Sujata Rao; Enhancing by David Holmes and Emelia Sithole-Matarise

: .