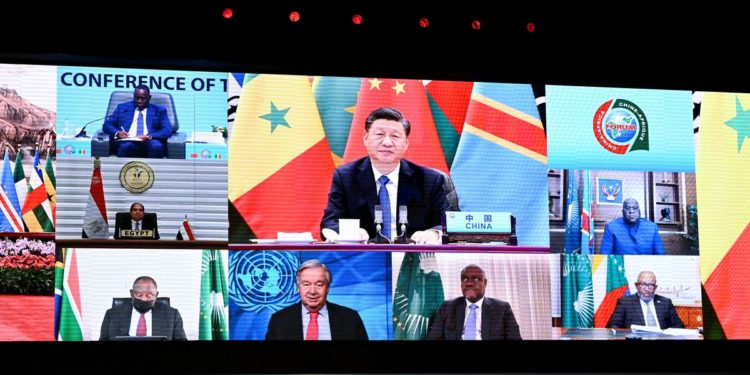

China’s President Xi Jinping, Senegal’s President Macky Sall, Congo’s President Felix Antoine Tshisekedi, Egypt’s President Abdel Fattah al-Sisi, South Africa’s President Cyril Ramaphosa, United Nations (UN) Secretary Common Antonio Guterres, Chairman of the African Union Fee Moussa Faki Mahamat and Comoros? President Azali Assoumani attend the opening of the discussion board Discussion board on China-Africa Cooperation, (FOCAC) through video hyperlink in Dakar, Senegal November 29, 2021. REUTERS/Cooper Inveen/File Picture

Register now for FREE limitless entry to Reuters.com

LONDON/BEIJING, Sept 8 (Reuters) – In August, China’s ambassador to Zambia took to the stage at a brand new convention centre within the capital Lusaka, which he referred to as “a present from the Chinese language authorities to our Zambian buddies”, to talk about lending to the debt-laden southern African nation.

China is the world’s largest bilateral lender however discloses little on lending situations and in addition on the way it renegotiates with debtors in misery, so curiosity in the way it handles Zambian debt is intense, notably as extra nations resembling Sri Lanka wrestle to repay loans. learn extra

Leaders of the Group of Seven wealthy democracies have referred to as on China particularly to take a extra energetic function in serving to strained nations overhaul their debt burdens.

Register now for FREE limitless entry to Reuters.com

Shortly after ambassador Du Xiaohui’s Lusaka speech, China confirmed it had forgiven 23 interest-free loans to 17 African nations, making good on a pledge by President Xi Jinping on the 2021 Discussion board on China-Africa Cooperation (FOCAC). China stated the loans had matured however didn’t give additional element.

The announcement was welcome, however interest-free loans make up a tiny portion of China’s lending to the continent. African governments deal with them like grants anyway so there was little shock, in keeping with researchers and authorities officers.

This type of debt forgiveness, which China has achieved for greater than twenty years, masks a more durable stance on restructuring for the majority of its lending to creating nations beneath its Belt and Highway Initiative (BRI) launched in 2013, stated analysts.

“It is the lowest hanging fruit,” stated Hannah Ryder, chief government of Improvement Reimagined, an African-owned growth consultancy headquartered in Beijing.

“There may be extra that China might do.”

China typically doesn’t disclose lending phrases, whereas debt aid often comes by way of maturity extension or new lending slightly than write downs.

“China has lengthy offered varied sorts of help, together with interest-free loans, to Africa inside its capability, and actively supported the financial and social growth of African nations,” a Chinese language international ministry spokesperson informed Reuters in a written assertion. It didn’t reply to a query on how a lot the 23 forgiven loans have been price in complete.

Curiosity-free loans account for lower than 5% of the $843 billion in Chinese language mortgage commitments to 165 governments globally between 2000 and 2017 tracked by analysis lab AidData.

CLUES FROM ZAMBIA

Progress received off to a glacial begin on restructuring Zambia’s $17 billion of exterior debt – Africa’s first pandemic period default – by way of the Widespread Framework arrange by the Group of 20 main economies in 2020. Sources concerned within the course of have blamed China for the delay. learn extra

China’s international ministry denied this, saying it “doesn’t correspond to the details”.

“China has performed a constructive function in Zambia’s debt restructuring. It was by way of China’s promotion that the collectors committee was in a position to efficiently maintain two conferences,” it stated in a written response to Reuters.

The second assembly resulted in a restructuring dedication and paving the best way for the IMF to log off on a $1.3 billion lending programme. Nevertheless, aid provided by every creditor continues to be being negotiated. learn extra

China could push for lengthy maturity extensions to its $6 billions of loans to Zambia slightly than accepting writedowns, a supply with data of the negotiations stated.

“The selection between haircuts and stretching the compensation interval… is a matter of negotiations,” Zambia’s finance minister Situmbeko Musokotwane informed a information convention final week, declining to touch upon China’s function particularly. learn extra

Some collectors “will select to have their cash sooner” whereas others would go for no haircut however compensation over an extended interval, Musokotwane added.

“In coping with the debt downside, the precept of “frequent motion and truthful burden” needs to be adopted,” China’s international ministry stated, in its assertion responding to criticism that it delayed the restructuring.

There may be uncertainty nonetheless over whether or not China would undertake a multilateral method for different indebted nations, resembling crisis-hit Sri Lanka, which defaulted on exterior debt that reached $47 billion on the finish of final 12 months.

Tokyo stated in late August it might coordinate with different creditor nations, together with India and China – Sri Lanka’s largest bilateral creditor – and urged joint restructuring talks. learn extra

“We’re able to work with related nations and worldwide monetary establishments,” Chinese language international ministry spokesman Zhao Lijian stated in response final week.

‘LASER-FOCUSED’

Between 2000 and 2020, Chinese language lenders, largely state-owned banks, agreed to lend $160 billion to African nations, in keeping with Boston College.

China wrote off at the very least $3.4 billion of debt between 2000 and 2019, nearly all interest-free loans to African nations, whereas independently, state-owned lenders restructured or refinanced $15 billion, in keeping with Johns Hopkins College’s China Africa Analysis Initiative (CARI).

Chinese language state-owned banks have been “laser-focused” on getting repaid, stated AidData’s Brad Parks, noting that Congo Republic renegotiated $1.3 billion of loans from China Eximbank in 2019 by lengthening maturities and growing rates of interest. The debt rose to $1.6 billion.

Beijing’s ambassador to Zambia stated in his August speech, “we did not need to go into the G20 collectors committee, the Widespread Framework,” including pleasant bilateral cooperation was “the easiest way to cope with debt between two buddies.”

Du added, nonetheless, that an “necessary” Could 31 name between Zambia’s and China’s presidents satisfied Beijing to hitch multilateral talks. learn extra

“China is having an actual, wholesome set of deliberations on how you can cope with their first ever mammoth debt disaster and they need to be applauded for his or her deliberations,” stated Kevin Gallagher, professor of worldwide growth coverage at Boston College.

“But when they do not act fast, it’s going to solely worsen.”

(This story corrects title of Johns Hopkins College in chart 2, corrects to learn “bln” (not m) in charts 1 and three)

Register now for FREE limitless entry to Reuters.com

Reporting by Rachel Savage in London and Martin Quin Pollard and Yew Lun Tian in Beijing; Further Reporting by Tetsushi Kajimoto in Tokyo, Jorgelina do Rosario and Marc Jones in London, and Chris Mfula in Lusaka; Enhancing by Karin Strohecker and Alexandra Hudson

: .