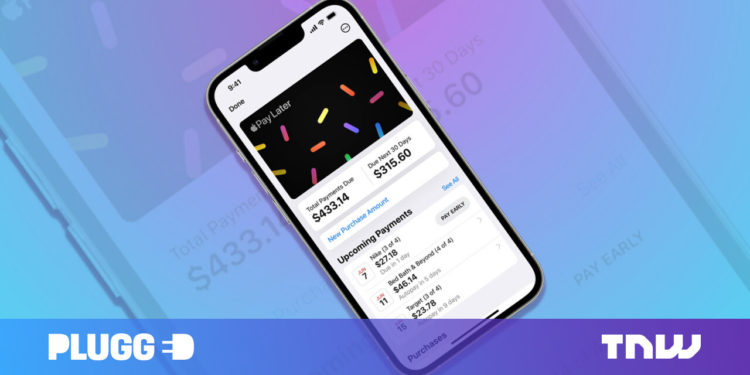

Apple has joined the thriving “purchase now, pay later” business, with a custom-made service known as Apple Pay Later. The service was introduced earlier this week on the 2022 Worldwide Builders Convention, and can initially be launched in the USA later this year.

Pay Later will probably be constructed into the Apple Pockets and eligible to be used on any buy made by way of Apple Pay. Clients will have the ability to break up the price of a purchase order into 4 equal funds, with zero curiosity and charges, unfold over a interval of four months.

To qualify, nonetheless, Apple will first do a soft credit check on customers wanting to make use of the service. The know-how behemoth claims it has designed the characteristic with “customers’ monetary well being in thoughts”.

It’s doubtless Apple is making an attempt to consolidate its foothold on the planet of shopper finance, and enhance its profitability. And customers ought to pay attention to the dangers of utilizing such a service.

Apple: the buyer darling

With the launch of Pay Later, Apple will probably be competing with many different comparable fin-tech firms together with PayPal, Block, Klarna and AfterPay – a few of which noticed their share costs fall following Apple’s announcement.

Apple will profit from its big market and model energy, with the potential to draw tens of millions to its services and products. And with an acute give attention to buyer expertise, Apple has managed to foster a group of evangelists. There’s little doubt the corporate is a consumer darling.

Furthermore, Apple has established an ever-growing ecosystem wherein customers are inspired to faucet into Apple services and products as a lot, and as usually, as potential – resembling by making funds by way of their iPhone as a substitute of a financial institution card.

The tech big offers methods to combine once-separate computing capabilities right into a telephone or wristwatch – whereas protecting the consumer’s experience in focus. Pay Later enhances this customer-centric expertise additional. It’s yet another method customers can combine the instruments they want inside a single ecosystem.

What’s in it for Apple?

Apple stands to make monetary positive factors by way of Pay Later, thereby including to its backside line. Presently its attain within the retail world is obvious, with iPhone-based cost providers accepted by 85% of US retailers.

One 2021 survey discovered that about 26% of regular online shoppers in Australia used purchase now, pay later providers.

As Apple’s clients more and more begin to use the Pay Later service, it’s going to achieve from service provider charges. These are charges which retailers pay Apple in alternate for with the ability to supply clients Apple Pay. As well as, Apple may also achieve helpful perception into customers’ buy behaviors, which is able to enable the corporate to foretell future consumption and spending conduct.

To ship the purchase now, pay later service, Apple has joined forces with Goldman Sachs, who will finance the loans.

This relationship has been in place since 2019, with Goldman Sachs additionally appearing as a associate for the Apple bank card (though Pay Later is just not tied to the Apple bank card). This strategic partnership has helped Apple achieve robust footing on the planet of shopper finance.

Challenges for customers

The truth is that the world of unregulated finance, which incorporates purchase now, pay later, doesn’t bode properly for all customers.

Youthful demographics (resembling Gen Z and millennials) and low-income households might be more vulnerable to the dangers related to utilizing these providers – and may rack up debt consequently.

Purchases by way of purchase now, pay later schemes can also be pushed by a need to personal the newest gadgets and luxury goods – a message pushed onto customers by way of slick advertising and marketing. They will situation customers to make purchases with out feeling the ache of parting with chilly, exhausting money.

From a shopper psychology perspective, these providers encourages instant gratification and put youthful folks on the consumption treadmill. In different phrases, they might regularly spend more cash on purchases than they’ll truly afford.

Lacking funds on Pay Later would negatively affect a person’s credit rating, which might then have antagonistic outcomes resembling not qualifying for conventional loans or bank cards.

A give attention to consumerist conduct also can set off an “ownership effect”. That is when folks grow to be connected to their purchases and are unlikely to return them, even when they’ll’t afford them.

Apple’s technology-driven and consumer-centric advertising and marketing provides it an edge over different purchase now, pay later schemes. It claims the service is designed with customers’ monetary well being in thoughts. However as is the case with any of those providers, customers ought to concentrate on the dangers and handle them rigorously. ![]()

This text by Rajat Roy, Affiliate Professor, Bond Enterprise Faculty, Bond University, is republished from The Conversation below a Artistic Commons license. Learn the original article.