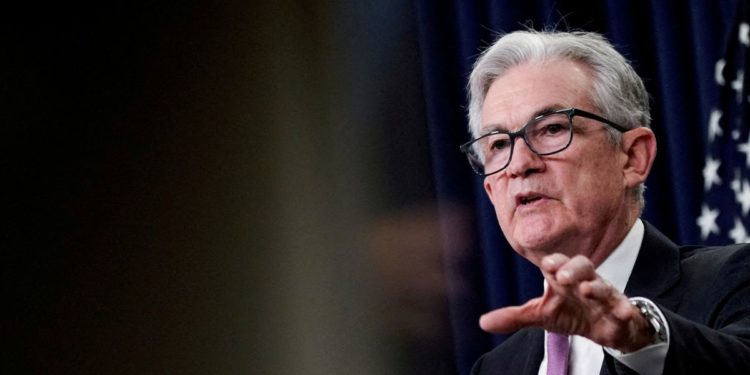

NEW YORK, Aug 24 (Reuters) – The greenback rose and Treasury yields jumped on Wednesday forward of a speech in two days by Federal Reserve Chair Jerome Powell that will affirm the U.S. central financial institution’s aggressive coverage to tame inflation or sign a “pivot” to subdued rate of interest hikes.

U.S. and European shares gained in uneven commerce as buyers tried to divine whether or not the Fed was extra prone to sluggish fee hikes or keep aggressive till it brings inflation right down to its goal of two%.

Yields on each German and U.S. benchmark 10-year notes rose to eight-week highs. British short-dated authorities bond yields hit 14-year highs. Hovering vitality costs in Europe raised fears of extra inflation in Germany and Britain.

Register now for FREE limitless entry to Reuters.com

The yield on 10-year U.S. Treasuries rose additional above 3%, hitting 3.126%, suggesting for some the rebound in shares could also be short-lived. The German 10-year bund rose to 1.388%, and two-year UK gilts hit 2.955%.

“When the 10-year climbs above 3%, rapidly shares have a more durable time. We noticed that in Could, we noticed that in June, we’re seeing it once more now,” mentioned Anthony Saglimbene, chief market strategist at Ameriprise Monetary in Troy, Michigan.

“That might be a headwind, so long as the 10-year stays above 3%,” he mentioned of the benchmark Treasury be aware.

Bets in current days on how a lot the Fed will increase charges at its September coverage assembly have whipsawed between 50 to 75 foundation factors.

Merchants of fed funds futures final priced in a 60.5% likelihood that the Fed will increase charges by 75 foundation factors subsequent month, and a 39.5% chance of a 50-basis level enhance.

“The market is gyrating between this extremely, extremely hawkish view and this extremely, extremely dovish view” of the banking symposium in Jackson Gap, Wyoming on Friday, Saglimbene mentioned. “It may be someplace within the center.”

The Dow Jones Industrial Common (.DJI) closed up 0.18%, the S&P 500 (.SPX) gained 0.29% and the Nasdaq Composite (.IXIC) superior 0.41%. All 11 S&P 500 sectors rose, as did small cap shares (.RUT).

In Europe, the pan-regional STOXX 600 index (.STOXX) closed up 0.16% and MSCI’s gauge of shares throughout the globe (.MIWD00000PUS) was basically flat, up 0.02%.

The euro fell to a two-decade low earlier than edging up 0.05% to $0.9972. The greenback index rose 0.037%.

For portfolio managers awaiting Powell’s commentary, all the pieces else is merely hypothesis, mentioned Michael James, managing director of fairness buying and selling at Wedbush Securities in Los Angeles.

“The (inventory) market is buying and selling round on not a lot apart from sentiment and the truth that we obtained fairly overbought and type of due for a pullback,” he mentioned. “Now we’re bouncing a little bit bit, positioning into the Fed chair’s commentary at Jackson Gap.”

Financial knowledge confirmed new orders for U.S.-made capital items elevated in July, however the tempo slowed from June, suggesting enterprise spending on gear might battle to rebound after contracting within the second quarter. learn extra

Orders for non-defense capital items excluding plane, a carefully watched proxy for enterprise spending plans, rose 0.4% final month, the Commerce Division mentioned on Wednesday. These so-called core capital items orders surged 0.9% in June.

Oil costs rose in unstable buying and selling on issues that the USA won’t take into account further concessions to Iran in its response to a draft settlement that might restore Tehran’s nuclear deal and doubtlessly crude exports by that member of the Group of Petroleum Exporting International locations.

Benchmark Brent crude retreated after rising above $100 a barrel. Saudi Arabia has recommended that OPECand its allies might take into account reducing output, although bearish financial indicators from central bankers are weighing.

U.S. crude futures settled up $1.15 at $94.89 a barrel and Brent rose $1.00 to $101.22.

U.S. gold futures settled unchanged at $1,761.50 an oz..

Register now for FREE limitless entry to Reuters.com

Reporting by Herbert Lash, further reporting by Alun John in Hong Kong and Tom Westbrook in Singapore; Enhancing by Tomasz Janowski, Bernadette Baum, David Gregorio and Richard Chang

: .