To shut observers of Wall Road, the autumn of Sam Bankman-Fried carried a curious twist: The person whose unbridled recklessness could have led to one of many largest monetary frauds in historical past began his buying and selling profession — and met a lot of his future lieutenants — at an under-the-radar agency identified for holding a good grip on its monetary threat.

The collapse of FTX, the cryptocurrency change that Mr. Bankman-Fried based, has drawn consideration to Jane Road Capital, a behemoth Wall Road agency that has few outdoors shoppers and principally invests its personal cash. However when Mr. Bankman-Fried joined Jane Road recent out of faculty in 2014, its repute for threat administration wasn’t what attracted him.

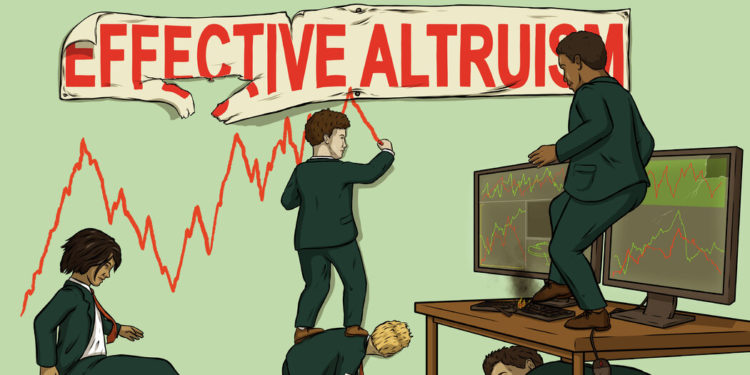

As an alternative, he went there due to his curiosity in a philanthropic motion referred to as efficient altruism, which holds that taking a high-paying job is worth it if the tip purpose is to provide a lot of the earnings away.

Mr. Bankman-Fried had heard about Jane Road via the efficient altruists he already knew — a lot of them younger, with roots within the expertise business. As soon as he joined the agency, figuring out of its essential workplace in downtown Manhattan, he constructed ties with greater than half a dozen colleagues with related views, who later turned a part of the FTX universe.

Amongst them was Caroline Ellison, a onetime romantic associate who later ran Alameda Analysis, a crypto buying and selling agency that Mr. Bankman-Fried based after leaving Jane Road.

“The kinds of people who find themselves into efficient altruism should not the kind of people that would flourish” in funding banking, William MacAskill, a British thinker who is taken into account a frontrunner of the motion, mentioned in an April interview with The New York Instances. “However Jane Road has this very nerdy, mental tradition, so it’s a greater match.”

Mr. MacAskill was one in all a number of folks with connections to Mr. Bankman-Fried who spoke to The Instances final yr, earlier than many distanced themselves within the wake of FTX’s collapse.

Jane Road, which had change into informally related to the efficient altruism motion, appeared like an apparent place to begin. The agency projected an anti-Wall Road bent, the place informal clothes was the norm effectively earlier than the pandemic and enjoying puzzles was part of a trader’s training. It recruited closely from school campuses equivalent to M.I.T., Carnegie Mellon and the College of California, Berkeley; paid junior staff handsomely; promoted a flat hierarchy; and noticed little turnover.

A spokesman for Jane Road mentioned that many individuals on the agency have been concerned in philanthropic giving, some donating to causes related to efficient altruism, however that Jane Road itself by no means had any connection to the motion. He declined to make anybody on the agency accessible for an interview.

The agency was based in 2000 by Tim Reynolds, Rob Granieri and Michael Jenkins, all former merchants at Susquehanna Funding Group, and Marc Gerstein, a former IBM developer. It was among the many handful of buying and selling corporations that used its personal, or “proprietary,” belongings to commerce, somewhat than handle cash on behalf of pension funds and different huge traders.

What to Know About the Collapse of FTX

What’s FTX? FTX is a now bankrupt firm that was one of many world’s largest cryptocurrency exchanges. It enabled prospects to commerce digital currencies for different digital currencies or conventional cash; it additionally had a local cryptocurrency often known as FTT. The corporate, primarily based within the Bahamas, constructed its enterprise on dangerous buying and selling choices that aren’t authorized in the US.

Jane Road was among the many corporations that led the evolution of monetary markets on the flip of the century, combining mathematical fashions — or algorithmic packages — with advances in expertise to commerce in milliseconds. At the moment, it is among the most dominant world buying and selling corporations, with greater than 2,000 staff.

It constructed its enterprise round arbitrage, a buying and selling technique that exploits tiny worth variations between very related investments. That paid off through the pandemic, when it pocketed $8.5 billion in revenue in 2020 amid the market volatility, based on paperwork seen by The Instances. The agency’s revenue in its founding yr was $16 million.

As a result of Jane Road constructed its personal expertise, it usually sought to rent current graduates who might be educated to make use of its programs simply, like mathematicians or laptop scientists. Job listings usually said that prior information of finance or economics was not a prerequisite.

Given the pace and complexity of so-called quantitative buying and selling, figuring out and managing threat turned a brand new problem. The agency’s concentrate on controlling threat — which Mr. Jenkins as soon as likened to a stint he spent engaged on a nuclear submarine — turned a core a part of its identification. By a spokesman, Mr. Jenkins declined to remark.

It’s unlikely that Jane Road would have change into one of many world’s largest buying and selling corporations “with out having embedded excellent threat administration self-discipline, insurance policies and programs into every little thing,” mentioned Paul Rowady, director of analysis at Alphacution Analysis Conservatory.

“Can’t occur,” he mentioned.

Struggling to resolve what he would do after graduating from the Massachusetts Institute of Know-how, Mr. Bankman-Fried had lunch with Mr. MacAskill. He inspired him to take a high-paying job and donate his earnings to charity.

In 2012, a Princeton graduate, Matt Wage, joined Jane Road and was later featured in a Instances opinion column by Nicholas Kristof as an exemplar of the “earn to provide” philosophy.

“He created a little bit of the transfer for plenty of folks to work at Jane Road,” Mr. MacAskill mentioned of Mr. Wage.

Ms. Ellison, who would go on to run Alameda, the buying and selling arm that Mr. Bankman-Fried based earlier than beginning FTX, obtained a job at Jane Road after she graduated from Stanford in 2016. In a March interview, she mentioned that early in her tenure at Jane Road, Mr. Bankman-Fried had reached out over electronic mail as a result of that they had mutual mates within the efficient altruism neighborhood.

“I used to be form of afraid of him,” Ms. Ellison mentioned. “You can inform he was fairly good and form of intimidating.”

Mr. Bankman-Fried additionally met Brett Harrison at Jane Road, and recruited him to run FTX’s U.S. operations in 2021. In an interview final week, Mr. Harrison mentioned the 2 of them had bonded over their dedication to animal rights. Mr. Bankman-Fried, a vegan, would usually eat French fries for lunch, Mr. Harrison recalled.

Mr. Bankman-Fried’s youthful brother and political adviser, Gabriel Bankman-Fried, who additionally recognized with efficient altruism, briefly labored for Jane Road after his brother left. Two different merchants, Xiaoyun Zhang, who goes by Lily, and Duncan Rheingans-Yoo, obtained their begin at Jane Road earlier than leaving early final yr to discovered Modulo Capital, a hedge fund backed by FTX. And Mr. Rheingans-Yoo’s older brother, Ross, labored at Jane Road earlier than taking a job final spring at FTX’s charitable basis, which was constructed on the rules of efficient altruism.

If Jane Road was a gathering floor for younger adherents of efficient altruism, it wasn’t the coaching floor for the dangerous and fraudulent actions that prosecutors say Mr. Bankman-Fried pursued at FTX.

The Aftermath of FTX’s Downfall

The spectacular collapse of the crypto change in November has left the business shocked.

Federal prosecutors contend that he orchestrated a scheme to loot buyer deposits and misdirected billions of {dollars} in buyer cash to gasoline buying and selling at Alameda, make tens of hundreds of thousands in marketing campaign donations, purchase costly Bahamas actual property and make investments greater than $4 billion in over 300 crypto firms and different ventures.

Mr. Bankman-Fried, who labored at Jane Road for 3 years, absorbed the agency’s buying and selling type, making use of the identical rules of arbitrage to crypto buying and selling at Alameda that Jane Road used to revenue on shares and different belongings.

However he doesn’t seem to have taken the danger administration classes to coronary heart.

“If there was something associated to threat or compliance, that went above him,” mentioned Mr. Harrison, the previous head of FTX’s U.S. enterprise, who has since disavowed Mr. Bankman Fried. “Maybe he had tasted simply sufficient success at Jane Road to make him assume he might do all of it on his personal, with out appreciating the magnitude of the operation that was being efficiently administered at Jane Road.”

Mr. Harrison introduced on Twitter in September that he deliberate to step down as head of FTX’s regulated U.S. enterprise and change into extra of an adviser to the corporate.

In January, Mr. Harrison said on Twitter that he was unaware of the alleged unlawful actions at FTX however had change into more and more disenchanted with how the corporate was being run. Mr. Harrison is now working a brand new firm, Architect, which can develop crypto buying and selling software program, and the place his chief expertise officer can be a Jane Road alum.

Quickly after leaving Jane Road in 2017, Mr. Bankman-Fried began work on Alameda. That quick pivot upset some folks at Jane Road, based on an individual accustomed to the scenario, as a result of Mr. Bankman-Fried was beginning a rival buying and selling agency and recruiting outdated colleagues.

Very like FTX, the relationships Mr. Bankman-Fried developed in these early years at Jane Road have imploded.

In December, Ms. Ellison pleaded responsible to fraud and agreed to cooperate with prosecutors, as did one other former high govt at FTX. Modulo has change into a spotlight for federal prosecutors in addition to FTX’s chapter attorneys, who’re looking for to get better the $400 million it acquired from Mr. Bankman-Fried.

Not lengthy after the FTX collapse, Mr. Harrison, in a collection of posts on Twitter, mentioned that he had “fond reminiscences” of Mr. Bankman-Fried at Jane Road however that when he went to work for him within the warmth of FTX’s enlargement, the Sam he knew had gone.

“I noticed he wasn’t who I remembered,” Mr. Harrison wrote.