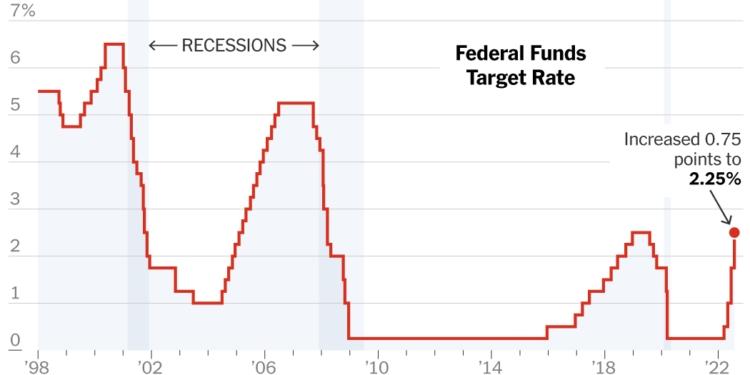

Because the Federal Reserve has lifted its key rate of interest, People have seen the results on each side of the family ledger: Savers profit from larger yields, however debtors pay extra.

Credit score Playing cards

Bank card charges are intently linked to the Fed’s actions, so customers with revolving debt can anticipate to see these charges rise, normally inside one or two billing cycles. The common bank card charge was not too long ago 17.25 p.c, in response to Bankrate.com, up from 16.34 p.c in March, when the Fed started its sequence of charge will increase.

“With the frequency of Federal Reserve charge hikes this yr, it is going to be a drumbeat of upper charges for cardholders each couple of assertion cycles,” stated Greg McBride, the chief monetary analyst at Bankrate.com.

Automotive Loans

Automotive loans are additionally anticipated to climb, however these will increase proceed to be overshadowed by the rising value of shopping for a automobile and the worth you pay for filling it with fuel. Automotive loans have a tendency to trace the five-year Treasury observe, which is influenced by the Fed’s key charge — however that’s not the one issue that determines how a lot you’ll pay.

A borrower’s credit score historical past, the kind of automobile, mortgage time period and down cost are all baked into that charge calculation.

The common rate of interest on new-car loans was 5 p.c within the second quarter, in response to Edmunds, up from 4.4 p.c in the identical interval final yr. Final month, the share of new-car patrons paying $1,000 or extra monthly on their loans reached a file of practically 13 p.c, Edmunds stated.

Scholar Loans

Whether or not the speed improve will have an effect on your pupil mortgage funds depends upon the kind of mortgage you could have.

Present federal pupil mortgage debtors — whose funds are on pause via August — aren’t affected as a result of these loans carry a fixed rate set by the federal government.

However new batches of federal loans are priced every July, primarily based on the 10-year Treasury bond public sale in Might. Charges on these loans have already jumped: Debtors with federal undergraduate loans disbursed after July 1 (and earlier than July 1, 2023) can pay 4.99 p.c, up from 3.73 p.c for loans disbursed the year-earlier interval.

Non-public pupil mortgage debtors also needs to anticipate to pay extra: Each fastened and variable-rate loans are linked to benchmarks that monitor the federal funds charge. These will increase normally present up inside a month.

Mortgages

Charges on 30-year fastened mortgages don’t transfer in tandem with the Fed’s benchmark charge, however as an alternative monitor the yield on 10-year Treasury bonds, that are influenced by quite a lot of components, together with expectations round inflation, the Fed’s actions and the way buyers react to all of it.

Mortgage charges have jumped by greater than two share factors because the begin of 2022, although they’re down from their highs, as fears of recession have led merchants to mood their expectations for Fed charge will increase sooner or later, regardless of stubbornly excessive inflation, pushing bond yields decrease in current weeks.

Charges on 30-year fastened charge mortgages averaged 5.54 p.c as of July 21, in response to Freddie Mac’s main mortgage survey, down from 5.81 p.c a month in the past however up sharply from 2.78 p.c a yr in the past.

Different dwelling loans are extra intently tethered to the Fed’s transfer. House fairness traces of credit score and adjustable-rate mortgages — which every carry variable rates of interest — usually rise inside two billing cycles after a change within the Fed’s charges.

Financial savings Automobiles

Savers looking for a greater return on their cash could have a neater time — yields have been rising, although they’re nonetheless fairly meager.

A rise within the Fed’s key charge typically means banks can pay extra curiosity on their deposits, although it doesn’t all the time occur immediately. They have a tendency to boost their charges once they need to carry extra money in — many banks already had loads of deposits, however that could be altering at some establishments.

Charges on certificates of deposit, which have a tendency to trace equally dated Treasury securities, have been ticking larger. The common one-year C.D. at on-line banks was 1.9 p.c in June, up from 1.5 p.c the month prior, in response to DepositAccounts.com.

The common five-year C.D. was 2.9 p.c in June, up from 2.5 p.c in Might.