The Federal Reserve raised rates of interest by three-quarters of a proportion level on Wednesday, persevering with its aggressive marketing campaign to chill fast inflation even because the financial system begins to gradual.

Central bankers voted unanimously to make the unusually massive interest-rate transfer, and the policy-setting Federal Open Market Committee signaled in its post-meeting statement that extra is coming, saying that it “anticipates that ongoing will increase within the goal vary can be applicable.”

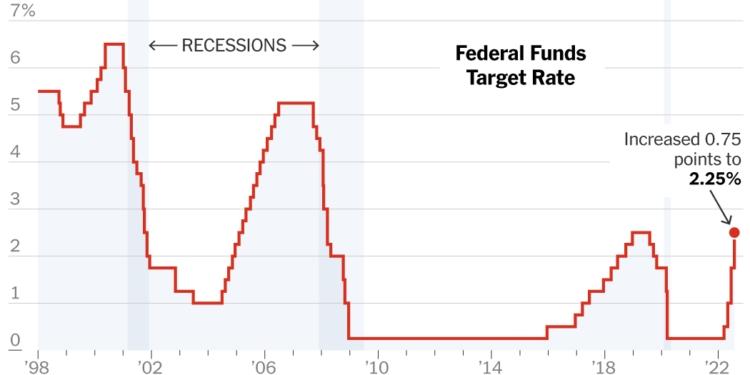

The Fed’s coverage charge, which trickles out by the financial system to have an effect on different borrowing prices, is now set to a spread of two.25 to 2.5 %.

The Fed started elevating rates of interest from near-zero in March, and policymakers have picked up the tempo since. After making a quarter-point transfer to begin, they raised by half some extent in Could and by three-quarters of some extent in June, which was the most important single step since 1994.

Fed officers made a second supersize improve on Wednesday as a result of they’re making an attempt urgently to wrestle fast inflation again underneath management.

Listed here are the takeaways from Wednesday’s determination and Fed Chair Jerome H. Powell’s post-meeting information convention:

One other large charge transfer might be coming in September.

Mr. Powell was clear {that a} third, “unusually” massive three-quarter-point charge improve is feasible on the Fed’s subsequent assembly. However he was clear that we now have a very long time between at times, and officers can be watching every new piece of knowledge as they make choices.

Mr. Powell doesn’t assume the U.S. is in a recession.

He highlighted proof that the financial system is slowing, however mentioned it was not but clear by how a lot. Mr. Powell additionally pointed to the energy of the labor market as a motive he doesn’t assume the financial system is at the moment in a downturn. And he cautioned that contemporary knowledge on financial progress set for launch on Thursday ought to be taken with “a grain of salt.”

A downturn just isn’t inevitable.

Mr. Powell mentioned that he thinks a slowdown isn’t assured, although he highlighted that it might be tough to decrease inflation with out one, and famous that the trail towards avoiding such a downturn has “narrowed.”

However “we want progress to gradual,” Mr. Powell mentioned.

Some slowing of the financial system is sweet from the Fed’s perspective, Mr. Powell emphasised. Whereas cooling off financial exercise sufficient to decrease inflation will most likely contain weakening the labor market, a bit of little bit of ache is critical now to place the financial system on a extra sustainable path. “We don’t need this to be larger than it must be,” Mr. Powell mentioned, however when serious about the medium and long run, “value stability is what makes the entire financial system work.”

Mr. Powell’s feedback have been exactly what inventory traders needed to listen to.

Traders have fearful in regards to the Fed tipping the American financial system into recession, so Wall Road on Wednesday honed in on alerts that the Fed might gradual its tempo of rate of interest will increase sooner or later and that Mr. Powell is conscious of early indicators of a slowdown within the financial system.

The S&P 500 inventory index ended the day up 2.6 %, and the Nasdaq Composite posted its finest day since April 2020. Markets can rapidly change their tune, although, particularly with new knowledge on progress popping out Thursday. The final two occasions the Fed raised charges, the S&P 500 rallied on the day of the announcement however fell sharply the day after.