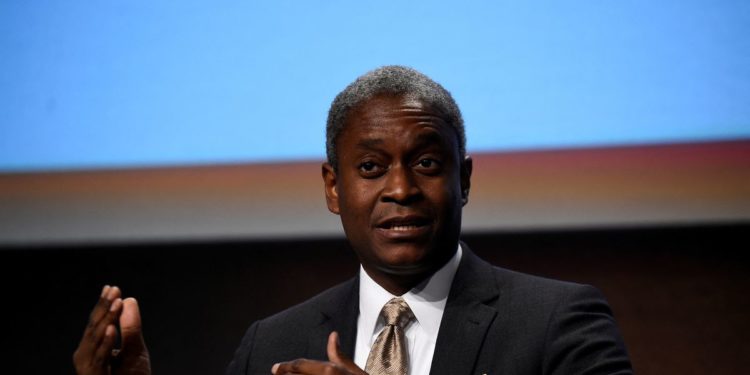

WASHINGTON, Oct 5 (Reuters) – The U.S. Federal Reserve’s battle in opposition to inflation is probably going “nonetheless in early days,” Atlanta Fed president Raphael Bostic mentioned Wednesday, changing into the newest U.S. central banker to warning in opposition to the probability charges could be decreased in response to any weakening of the financial system.

Regardless of “glimmers of hope” in latest knowledge, Bostic mentioned “the overarching message I’m drawing…is that we’re nonetheless decidedly within the inflationary woods, not out of them,” with the Fed’s goal funds charge needing to rise to round 4.5% by the top of the yr.

In ready remarks to the Northwestern College Institute for Coverage Analysis, Bostic mentioned he wish to cap charges at that time lengthy sufficient to evaluate the place the financial system is heading.

Register now for FREE limitless entry to Reuters.com

However that doesn’t suggest charge cuts would comply with. The Fed’s singular focus is that inflation head decisively again to the central financial institution’s 2% goal.

There’s “appreciable hypothesis already that the Fed might start decreasing charges in 2023 if financial exercise slows and the speed of inflation begins to fall,” Bostic mentioned. “I’d say: not so quick.”

“We should always not let the emergence of (financial) weak spot deter our push to decrease inflation,” Bostic mentioned. “We should stay vigilant as a result of this inflation battle is probably going nonetheless in early days.”

The Fed meets once more on Nov. 1-2 with policymakers anticipated to approve one other three-quarter level charge hike even within the face of worldwide market volatility.

Register now for FREE limitless entry to Reuters.com

Reporting by Howard Schneider; Enhancing by Andrea Ricci

: .