”Survey says” appears at numerous rankings and scorecards judging geographic areas whereas noting these grades are greatest seen as a mixture of suave interpretation and knowledge.

Buzz: Home costs began 2022 with a dip in one-third of U.S. markets — together with Los Angeles County — as rising rates of interest, dear choices and shaky economics appeared to sit back the pandemic period’s shopping for binge.

Supply: My trusty spreadsheet reviewed quarterly median gross sales value stats for current single-family properties in 185 metropolitan areas tracked by the National Association of Realtors. I centered on quarter-to-quarter value modifications — as a substitute of the year-over-year efficiency that impressed the “First Quarter of 2022 Brings Double-Digit Value Appreciation for 70% of Metros” headline on the association’s press release announcing the latest edition of these statistics.

Topline

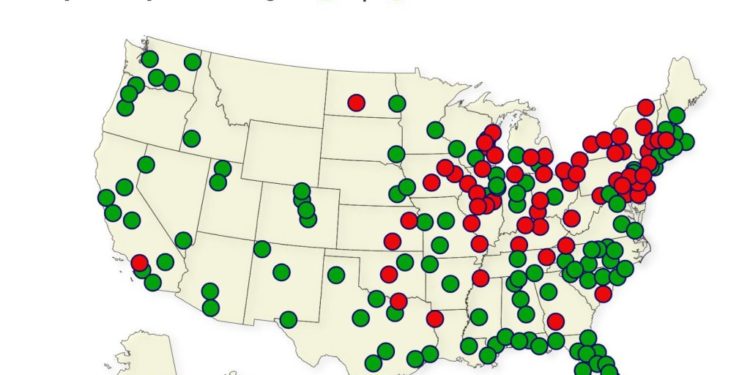

Regardless of what chances are you’ll be listening to about widespread pricing energy, the standard purchaser paid much less in 64 metros — or 35% of all markets tracked — between the primary three months of 2022 and final yr’s fourth quarter.

The declines had been concentrated in smaller markets within the Jap U.S. In actual fact, one of many Realtors’ 4 regional indexes — the Midwestern markets — fell 1%.

The weakest metro efficiency was in Rockford, Sick., down 11.3% in three months, adopted by Akron, Ohio, down 9.7%, Topeka, Kansas, down 9.5%, Springfield, Sick., down 9.1% and Binghamton, N.Y., down 7.7%.

Amongst eight California metros within the research, solely L.A. County had a quarterly decline of 0.7%. The closest dropping market was 1,300 miles east — Oklahoma Metropolis, off 1.6%.

And, sure, the Realtors’ total U.S. value index did rise 2.1% for the quarter.

Particulars

That is no anomaly. In actual fact, it’s an enchancment over the tip of 2021.

The fourth quarter noticed much more falling costs as 104 metros noticed declines — or 56% of the nation. California drops? Three of eight metros had been down: L.A. County off 7.3%, San Diego off 0.6% and San Francisco off 3%.

Even the U.S. value index fell 0.7% with regional dips within the Northeast (5%), Midwest (4.5%) and West (0.2%).

And final summer time, 36 metros had value declines — or 20% of the nation. California’s drops within the third quarter included three of eight metros: San Jose (2.9%), San Francisco (2.5%), and Orange County (0.9%). The U.S. value index rose 1.5% with no regional declines.

This identical math additionally particulars the madness of spring a yr in the past. In 2021’s second quarter, there was no quarterly value dips wherever within the nation. The U,S, median rose 12.4% in these three months.

Backside line

Just a few modest value drops should not an actual property disaster. But the home-selling business is fortunate that value discussions typically heart on year-over-year modifications.

So, house owners and their salespeople will concentrate on the truth that simply three U.S. metros had value declines within the 12 months led to 2022’s first quarter — Cape Girardeau, Mo., off 2%, Topeka, Kansas, off 1.9, and Rockford, Sick., off 1%. They’ll additionally cheer nationwide pricing that’s up 15.7% over that very same interval.

Measuring financial developments by taking a look at 12-month modifications tends to clean the ups and downs of any benchmark — whether or not the volatility is tied to differences due to the season, short-run impacts of occasions, or simply noise in an financial yardstick. However this statistical softening also can delay the truth verify that’s a lot wanted by markets of any asset at inflection factors.

Think about how Wall Road gyrations are considered.

After a turbulent first three months this yr, most traders centered on the Commonplace & Poor’s 500-stock index’s 5% decline between Dec. 31 and March 31 — the primary quarterly drop for the reason that 20% pummeling on the pandemic period’s begin.

This pullback suggests share costs aren’t backed up by financial fundamentals. Inflation stresses family budgets and company backside strains. Plus, pandemic, provide chain and geopolitical uncertainties zap confidence with customers and CEOs alike.

Few inventory traders revel within the year-over-year outcome: The S&P 500’s 15% achieve between the primary quarter and the identical interval a yr earlier.

Let’s be sincere. Actual property’s actuality isn’t a lot completely different. Costs defy financial logic. All of Wall Road’s big-picture worries are amplified by homebuying affordability being slashed by the obvious finish of the Federal Reserve-induced mortgage charge giveaways.

Don’t forget home hunters are sensible of us. At the least those that are in search of a house and never an funding.

These individuals dwell within the right here and now. They don’t seek for shelter by spending numerous time eager about what costs had been a yr in the past. Value indexes adjusted for seasonality or inflation or size of possession don’t change their budgets, mortgage charges or what’s in the marketplace.

So early 2022’s softer pricing is welcome information.

Jonathan Lansner is the enterprise columnist for the Southern California Information Group. He might be reached at jlansner@scng.com