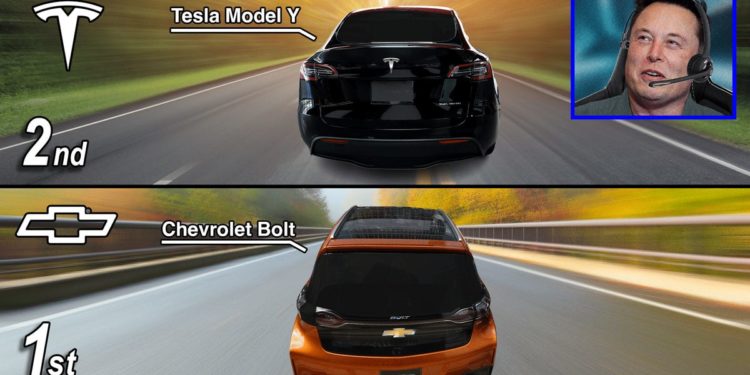

Sixteen years in the past, Tesla CEO Elon Musk introduced his aim of constructing the primary actually low-cost electrical household automotive. Now Common Motors has overwhelmed him to it.

INAugust 2006, earlier than Tesla had constructed its first electrical automotive, Elon Musk revealed his first “Master Plan” for the corporate with a singular aim: remodel the environmentally unfriendly auto business right into a pleasant one by promoting dear electrical automobiles that will underwrite the event of reasonably priced ones.

“When somebody buys the Tesla Roadster sports activities automotive, they’re truly serving to pay for growth of the low-cost household automotive,” Musk wrote.

Tesla has since rolled out 4 fashions cheaper than the $98,000 Roadster it began with in 2008, however none have been priced affordably or achieved Musk’s often-repeated aim of changing into a real mass-market model. As an alternative, the corporate has remained centered on automobiles with luxurious costs: Teslas begin at about $50,000 and their common promoting worth is $68,000, in keeping with Kelley Blue E-book. That’s effectively above the $30,000 to $45,000 worth vary most business observers assume is the candy spot for “the low-cost household automotive” Musk envisioned—a candy spot that one among Tesla’s unlikeliest rivals simply hit.

Tesla has now misplaced the reasonably priced EV race to Common Motors, which spurred Tesla’s creation after quitting the electrical car enterprise 20 years in the past. The Detroit-based automaker will supply its 2023 Bolt hatchback for less than $26,600, slashing the earlier sticker worth by $6,300. The marginally greater Bolt EUV loaded up with a high-end audio system, camera-based rearview mirror, sunroof and Tremendous Cruise for hands-free freeway driving prices simply over $34,000. And GM is providing one other low-cost EV subsequent yr: An electrical Equinox crossover that will get 300 miles per cost priced from $30,000, which is in step with gasoline-fueled rivals like Honda’s CR-V and Toyota’s RAV4.

“GM was the primary full-line producer to carry a long-range, reasonably priced EV to market with the Bolt EV when it launched again in 2017, and that continues to be a precedence,” GM President Mark Reuss tells Forbes, with out commenting on Tesla. Ruess says GM determined to reintroduce Bolt on the “lowest worth level in market” to “assist drive EV gross sales and adoption.”

They usually might quickly get even cheaper. A proposed extension of federal EV tax credit is making its means by Congress within the so-called Inflation Reduction Act of 2022. The invoice, if handed, might minimize the efficient base worth for a five-passenger Bolt to lower than $20,000 by a brand new $7,500 tax credit score, accessible on the time of buy.

GM’s Inexpensive EV Push

The Detroit-based carmaker has three mass-market fashions rolling out which might be cheaper than Tesla’s Mannequin 3 sedan and Mannequin Y crossover.

GM Newsroom

Chevrolet Bolt EUV (2023)

From $27,000

GM NEWSROOM

Chevrolet Equinox EV (2024)

Begins at $30,000

GM NEWSROOM

Chevrolet Blazer EV (2024)

Base worth is $45,000

Making electrical automobiles cheaper is significant as rising greenhouse emissions spur heatwaves, drought and more and more intense storms. That’s as a result of petroleum-powered automobiles and vans are the highest supply of U.S. carbon emissions, accounting for more than a third last year. To dramatically minimize them, EVs should go mainstream—and making them reasonably priced to the common American is a primary needed step. There are additionally potential bragging rights for corporations that do.

“To have a ‘most reasonably priced EV’ moniker behind you proper now will not be a nasty advertising transfer,” says Jeffrey Schuster, president of researcher LMC Automotive’s world forecasting unit. “I think they don’t seem to be making something on Bolt at that worth, however they don’t seem to be doing it for margin. They’re doing it for consciousness and market share, and to get automobiles on the market. Identical factor with a $30,000 Equinox. It is about attempting to carry EVs into the mainstream and likewise, clearly, erode Tesla’s dominance in that phase.”

“GM was the primary full-line producer to carry a long-range, reasonably priced EV to market with the Bolt EV when it launched again in 2017, and that continues to be a precedence.”

The Detroit-based automaker’s pricing strikes look significantly aggressive provided that the run-up in prices for batteries, semiconductors, uncooked supplies and different elements wanted to construct automobiles has pushed up general automotive costs, significantly for EVs. The common new electrical car value over $66,000 in June, in keeping with KBB, primarily due to Tesla’s excessive U.S. gross sales quantity. It jacked up costs considerably this yr, citing inflation stress, and isn’t saying when or in the event that they’ll come down.

“We have raised our costs … fairly just a few occasions. They’re frankly at embarrassing ranges,” Musk stated throughout Tesla’s second-quarter earnings name. “However we have additionally had numerous provide chain and manufacturing challenges and we have got loopy inflation. I am hopeful, this isn’t a promise or something, however I am hopeful that sooner or later, we are able to cut back the costs a bit of bit.”

Neither he nor Tesla responded to requests for touch upon GM’s pricing strikes.

IT’s price noting that Tesla doesn’t appear to care that it has misplaced the race for affordably priced EVs—and for now it doesn’t matter financially. Musk’s Austin, Texas-based firm hauled in $2.3 billion of internet earnings within the yr’s second quarter regardless of huge manufacturing losses attributable to Covid-related shutdowns in China, Tesla’s primary revenue supply. With its excessive costs, the corporate enjoys revenue margins which might be the envy of larger, conventional automakers.

“The main target of Tesla has developed over time and it has developed into extra of a luxurious model,” says Jeffrey Osborne, an fairness analyst who covers Tesla for Cowen. “The choice two earnings calls in the past to concentrate on the humanoid robotic Optimus Prime and never the mass market car means that’s a pivot that Tesla is content material with.”

Within the first half of the yr, Tesla reported a gross margin on its automotive enterprise of 30.6%. By comparability, GM’s EBIT-adjusted margin for its general operations was 8.9%. And since the corporate continues to see excessive demand globally, particularly for its $66,000 Mannequin Y crossover, it’s utilizing most of its present manufacturing facility capability to fulfill it; there’s little stress so as to add cheaper fashions.

“Promoting too many automobiles at too excessive or too worthwhile a worth will not be an issue for an automaker,” says ex-Tesla battery engineer Gene Berdichevsky, CEO of Sila, a battery anode maker. “That is creating one thing that folks genuinely need. It’s like the best way folks purchase an iPhone versus another telephone. They need it regardless that it prices extra.”

“To have a ‘most reasonably priced EV’ moniker behind you proper now will not be a nasty advertising transfer.”

Because the arrival of Tesla’s Mannequin S sedan a decade in the past, Musk has labored to make the model synonymous with high-performance, velocity and cutting-edge tech, like over-the-air wi-fi updates that permit present automobiles acquire new kinds of options and an Autopilot driver-assist function (which doesn’t do what the title implies and has run into regulatory issues). These are the sorts of issues that differentiate Tesla automobiles, enhance their desirability and assist them command premium costs.

However luxurious costs gained’t result in the sort of mass adoption of EVs Musk has at all times cited as Tesla’s aim. And in keeping with Fisker Inc. CEO Henrik Fisker, a veteran designer who styled premium automobiles for BMW, Aston Martin and, briefly, Tesla, Musk’s firm could now be a sufferer of its success.

“It’s very laborious for a luxurious automotive firm to make an affordable automotive,” he says. “It is simpler to begin from the opposite means round.”

Certainly, GM’s Bolt gained’t be mistaken for a luxurious automotive. Launched in late 2016, it’s in-built Orion, Michigan, utilizing a small car platform created by GM’s South Korean unit. When it comes to styling, it’s cute at greatest, quite than horny, and reeks of practicality. Acceleration is peppy and merging onto the freeway is a breeze, if missing the uncooked centrifugal pressure of a Tesla. Although labeled as a subcompact, the cabin is roomy, significantly for backseat passengers, and may carry copious quantities of stuff when the rear seats are folded down. It was named North American Automotive of the Yr in 2017, promoting about 23,300 models within the U.S. that yr, making it the third-best-selling EV behind Tesla’s Mannequin S and Mannequin X SUV.

“Promoting too many automobiles at too excessive or too worthwhile a worth will not be an issue for an automaker.”

It was retooled and freshened in late 2020, together with with the addition of the marginally greater Bolt EUV, and bought off to a robust begin earlier than defective batteries equipped by LG triggered recollects in 2021. The electronics firm agreed to pay GM about $2 billion over the matter and, after a months-long gross sales and manufacturing halt, a brand new pack was launched this yr. Consequently, GM’s worth minimize appears to be like as a lot mea culpa for the battery complications as a shrewd advertising transfer. And whereas Bolt’s measurement and flexibility make it an interesting car for metropolis dwellers, it lacks the majority and energy of bigger crossovers and pickups Individuals can’t cease shopping for (no less than when the fuel was low-cost).

“It will have labored higher in Europe than it did right here as a result of {the marketplace} in North America is at all times on the lookout for an SUV,” stated Michael Simcoe, a GM design government who oversaw the styling of the Bolt EUV.

However Bolt is barely the opening salvo within the battle to win gross sales away from Tesla and broaden the battery-car market. The bigger Equinox and Blazer fashions coming in 2023, whereas a bit costlier than Bolt, fall squarely into the extremely common mass marketplace for compact and midsize crossover automobiles. They’ll have a driving vary of 300 miles or extra per cost utilizing the corporate’s lower-cost batteries and lighter, cheaper EV structure. An electrical Silverado pickup arrives quickly, priced from the low $40,000s, to compete with Ford’s $40,000 F-150 Lightning and Tesla’s long-delayed Cybertruck. On the excessive finish, GM’s bought luxurious electrical Cadillacs and Hummers promoting for over $100,000 hitting the market.

These automobiles all use GM’s new Ultium system, which mixes a higher-powered, lower-cost battery pack, motor and lighter physique structure created particularly for electrical fashions. Finally, they’re a part of CEO Mary Barra’s aim of promoting 1 million EVs a yr by 2025.

“Current advances in lithium-ion battery know-how and growth work assist make high-mileage, reasonably priced EVs with nice design and efficiency a actuality,” says Reuss. “When extra clients are capable of expertise the advantages of EVs—from home-charging to instantaneous acceleration, glorious experience and dealing with and 0 emissions—they gained’t return.”

GM’s clearly not alone in concentrating on a broader swath of the U.S. market. Costs for quite a few fashions, together with Ford’s F-150 Lightning and Mustang Mach-E crossover and small electrical SUVs from Volkswagen, Hyundai, Kia, Toyota, Subaru and startup Fisker Inc. all begin within the high-$30,000s to mid-$40,000s.

Berdichevsky, who labored on Tesla’s first battery packs earlier than beginning his personal firm, thinks huge automakers are attempting to get to low costs too shortly given more and more excessive demand for and tight provides of batteries.

“If what you’re attempting to do is create a sustainable, accelerating enterprise, you have to attain for profitability on each automotive that you just ship and for each battery that you just’re capable of get your fingers on,” he stated. “It’s a mistake to go down market earlier than the availability chain is prepared.”

Header Picture Credit

Elon Musk: HANNIBAL HANSCHKE-POOL/GETTY IMAGES; Chevrolet Bolt: ROBYN BECK/AFP/GETTY IMAGES; Tesla Mannequin Y: JOE RAEDLE/GETTY IMAGES.