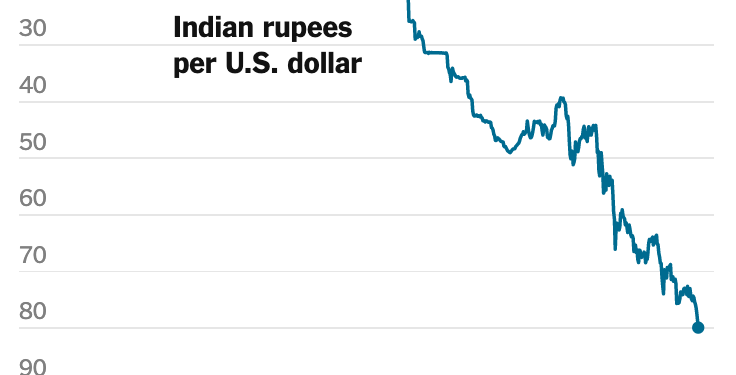

The Indian rupee touched the weakest stage on report in opposition to the greenback on Tuesday, one other sufferer of upper power costs and a stronger dollar.

The rupee has misplaced about 7 p.c of its worth in opposition to the greenback this yr as India has spent extra to import sources of power like crude oil, pure gasoline and coal. Costs of these commodities have climbed after Russia invaded Ukraine.

One other issue behind the decline of the rupee is uncertainty concerning the world financial system that has, in flip, propelled the greenback to a 20-year excessive in opposition to the currencies of its main buying and selling companions. Traders have pulled cash out of India and different creating nations and poured it into america, the place the Federal Reserve is elevating rates of interest aggressively to tame inflation.

“A whole lot of it’s greenback power fairly than rupee weak spot,” stated Rahul Bajoria, the chief economist for India at Barclays. “It nonetheless appears like on a relative foundation the rupee has finished lots higher,” he stated, pointing to the steeper declines within the worth of the euro and the British pound in opposition to the greenback.

On Tuesday, the rupee briefly crossed 80 to the greenback for the primary time. The Reserve Financial institution of India intervened out there, because it had in latest months, to bid up the foreign money, in response to native media reviews.

Because it has in a lot of the world, inflation has slowed financial development this yr in India. Reserve Financial institution officers responded by unexpectedly elevating charges in Might, after which once more in June to 4.9 p.c. However inflation stays around 7 percent, placing stress on family budgets.

Prime Minister Narendra Modi’s authorities has lower taxes on gas and restricted exports of wheat and sugar. And it has purchased extra Russian oil, which has grow to be cheaper after sanctions imposed by america and Europe.