There’s a number of confusion within the personal market proper now. On the one hand, enterprise corporations are nonetheless asserting new funds every day. They’re internet hosting catered sushi brunches. On the opposite, layoffs abound, and titans of trade sound nervous. JPMorgan’s Jamie Dimon sees an economic hurricane forward. For his half, Elon Musk reportedly instructed Tesla executives this week he has a “super bad feeling” in regards to the financial system. He’s additionally shedding 10% of Tesla’s salaried staff, he instructed them in a brief email this morning.

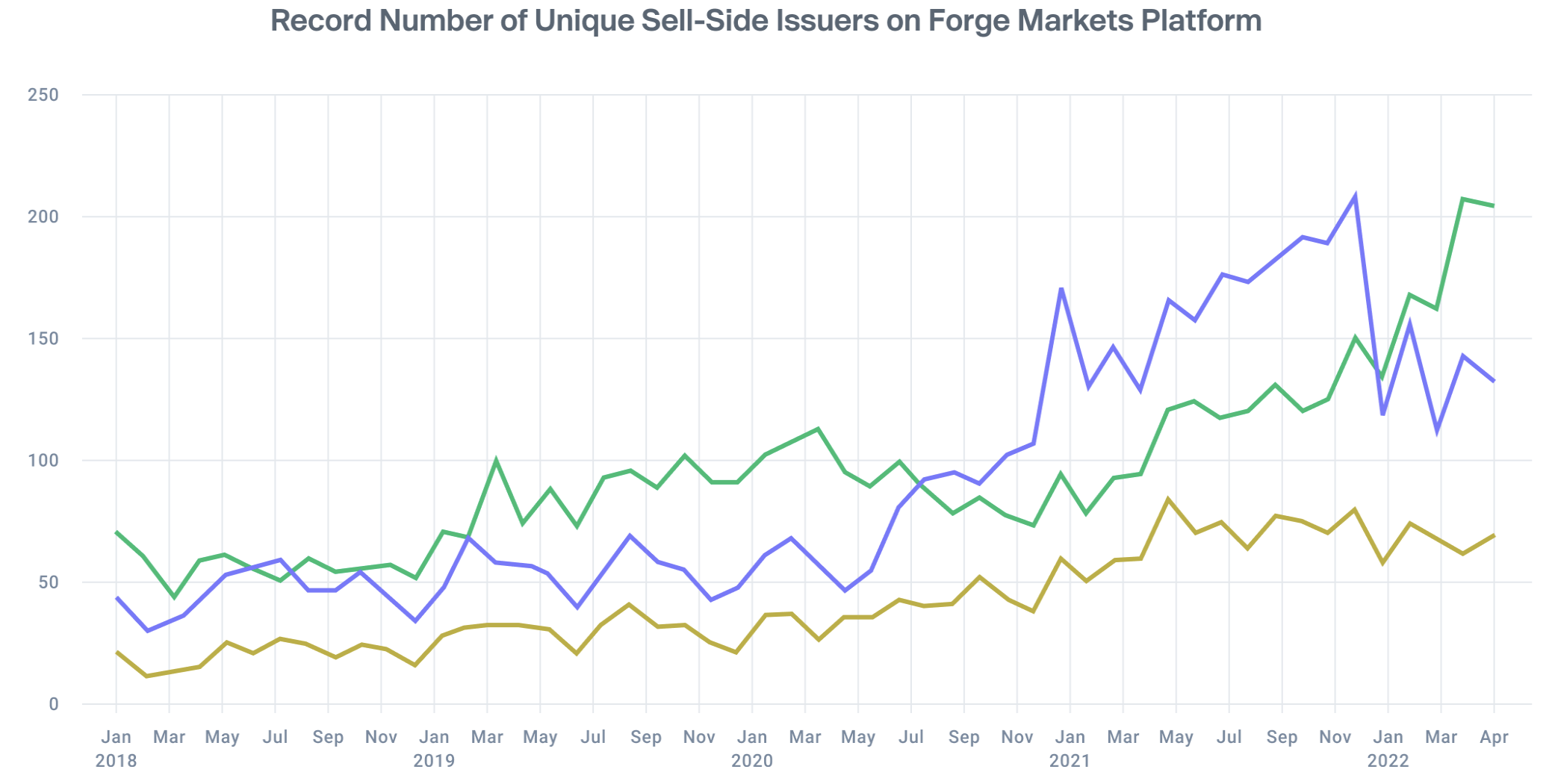

You can hardly blame folks seeking to promote their startup shares, or these seeking to purchase them, for feeling not sure about the place to satisfy on worth, and that’s precisely what’s taking place proper now, says secondary market consultants like CEO Kelly Rodriques of Forge Global. In truth, Rodriques says, on Forge, a buying and selling platform for personal corporations’ shares that went public earlier this yr through a SPAC, the “provide of personal shares proper now’s increased than it’s ever been in historical past — by so much.”

Rodriques calls it “worth disequilibrium. There’s a ton of vendor curiosity, however the vary between vendor and purchaser expectations is simply too huge for lots of buying and selling to occur.”

Picture Credit: Forge International

He’s not alone in seeing this sample. Justin Fishner-Wolfson individually says probably the most exceptional factor in regards to the secondary market proper now’s how stagnant it’s. Fishner-Wolfson cofounded and oversees 137 Ventures, a San Francisco-based agency that provides loans to founders, executives, early staff and different giant shareholders of personal, high-growth tech corporations in trade for the choice to transform their debt into fairness, and he notes that valuations within the personal markets are “gradual to vary” as a result of “persons are ready to see what issues are literally price.”

You possibly can hardly blame them, he suggests; the indicators throughout seem haywire. “If you happen to have a look at the general public markets, you’ve acquired even very giant corporations shifting 5 to 10 share factors a day, with out particular information. Like, this isn’t an earnings name that’s driving the worth.” On condition that “folks don’t actually know what issues are price on any given day,” he says, “within the personal markets, issues are principally simply slowing down whereas folks wait to see whether or not or not pricing is one thing [they] might kind of approximate as we speak, whether or not or not it will get worse from right here, [or] whether or not or not it will get higher from right here.”

Some sellers are plowing ahead at costs they may not like out of necessity. “The one transactions you’re seeing are those that individuals desperately have to have occur,” says Fishner-Wolfson. It’s true of corporations; it’s additionally true of people, he says. “Firms with sturdy stability sheets aren’t going to boost cash on this atmosphere; they’re going to attempt to delay [a new round] so long as they’ll.” He sees the identical with founders and executives. “If your organization is doing rather well, why do you need to take a worth that’s not an important worth, or at the very least an inexpensive worth, in case you can wait a couple of quarters, see how issues settle out, and get a greater deal later?”

There may be some excellent news for sellers, says Rodriques. For one factor, Rodriques says he’s seeing indicators that sellers are rising “extra life like” about their expectations, which ought to deliver extra patrons — who need the most important low cost attainable — to the desk.

He additionally says that whereas costs look like falling virtually uniformly, corporations that had been venture-backed and went public considerably lately are nonetheless buying and selling at premiums to the place they had been valued of their final personal funding rounds. Particularly, in response to Forge, they’re buying and selling at roughly a 24% premium to their pre-IPO valuations.

That’s method down from the fourth quarter, when corporations on Forge had been buying and selling at a 58% premium over their final personal spherical, however that cushion is preserving patrons, and sellers, out there who may disappear in any other case.

Rodriques factors, for instance, to the buy-now-pay-later startup Affirm, an organization that Forge had beforehand tracked and traded on its platform and which went public by means of a standard IPO course of early final yr. At present, Affirm’s shares are down 56% from their IPO worth, however they’re up greater than 70% from the worth that Affirm’s personal market buyers assigned them throughout the outfit’s final, pre-IPO spherical, which means its personal market buyers are nonetheless very a lot within the black.

How a lot that actually means is, in fact, a query mark. Requested if he would himself purchase Affirm’s shares at their present worth, Rodriques talks at size about Affirm being a ” extremely wanted companies that has a major sustainable gross margin profile and a progress price.”

“You possibly can say, ‘Effectively, it’s not price 28 occasions [revenue].’ And possibly [the shares] don’t return as much as 28 occasions [revenue], possibly they settle in at 20,” he continues. “However persons are nonetheless going to pay premiums — good market or dangerous market — for a corporation that’s throwing up natural progress of fifty% to 100% a yr and gross margins within the 70% to 90% [range].”

Requested once more: would he purchase it proper now or would he wait, Rodriques says he’s not so not like his personal clients. “Am I a purchaser of Affirm proper now? I’m like everyone else. I’m ready and watching. However I believe it’s an important firm, and I might spend money on it. I’m eager to see the place the market shakes out.”

Picture Credit: Forge International