For the primary time in three years, the circus is coming again to city.

The tv business’s largest showcase for advertisers, the so-called upfronts, will return to Manhattan landmarks like Radio Metropolis Music Corridor and Carnegie Corridor after the pandemic put the glitzy, in-person galas on maintain. Similar to within the outdated days, media executives will make their greatest pitch to influence entrepreneurs to purchase tens of billions of {dollars} of economic time within the coming months.

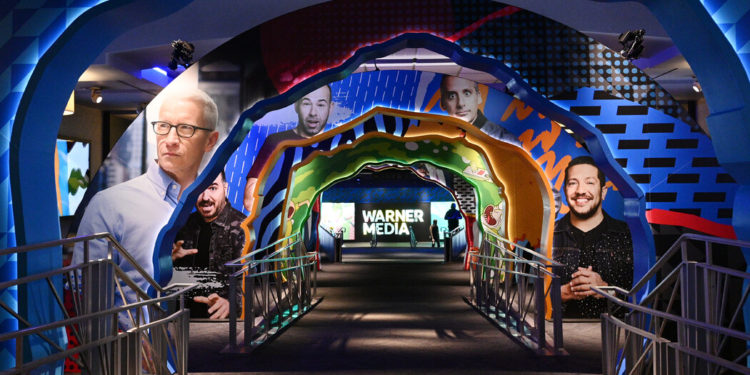

However due to the vastly modified media business, many points might be radically completely different. The businesses themselves have modified: CBS merged with Viacom after which renamed itself Paramount World, and WarnerMedia and Discovery accomplished a megamerger, forming Warner Bros. Discovery. The tech large YouTube is making its debut on the presentation lineup this week, and there may be already intrigue that Netflix may be a part of the fray subsequent 12 months.

And as a substitute of unveiling prime-time lineups that may roll out within the fall, media firms are anticipated to spend a big portion of their time speaking up promoting alternatives on streaming providers like HBO Max, Peacock, Tubi and Disney+. There’s good cause for that: Advertisers at the moment are allocating nearer to 50 p.c of their video budgets to streaming, up from round 10 p.c earlier than the pandemic, a number of advert consumers stated in interviews. The free ad-supported streaming platforms Tubi and Pluto had been highlights for his or her homeowners, Fox and Paramount, in the newest quarter.

“The upfronts was once ‘Right here’s 8, 9, 10 p.m. on Monday night time’ — I don’t assume anyone cares about that anymore,” stated Jon Steinlauf, the chief U.S. promoting gross sales officer for Warner Bros. Discovery. “You’re going to listen to extra about sports activities and issues like Pluto and fewer concerning the new Tuesday night time procedural drama.”

The courtship is not one-sided, when reluctant streaming platforms as soon as put a stiff arm to commercials. As subscriber development begins to sluggish for a lot of streaming providers, promoting — a mainstay of conventional media — is gaining attraction in its place income.

Netflix, which resisted advertisements for years however is aiming to debut an ad-supported tier later this 12 months after a subscriber hunch, is anticipated to play a bigger position in future upfronts. Disney+, which has to this point continued to extend its subscriber rely, stated this 12 months that it might additionally provide a less expensive choice buttressed by advertisements.

“Streaming is a part of each single dialog that we now have — there isn’t an exception primarily based on who your goal it’s, as a result of whether or not you’re focusing on 18-year-olds or 80-year-olds, they’re all accessing linked TV at this level,” stated Dave Sederbaum, the pinnacle of video funding on the advert company Dentsu.

Final 12 months, advert consumers spent $5.8 billion on nationwide streaming platforms, an quantity dwarfed by the $40 billion allotted to nationwide tv, in response to the media intelligence agency Magna. However tv gross sales peaked in 2016 and are anticipated to say no 5 p.c this 12 months, in contrast with a 34 p.c surge projected for streaming advert income as providers provide extra preproduced and reside content material.

The fast modifications in viewing habits have prompted many advertising executives to shift towards advertisements positioned by means of automated auctions and “away from legacy fashions like upfronts” the place “advertiser selection is proscribed,” stated Jeff Inexperienced, the chief govt of the ad-tech firm The Commerce Desk.

“As advertisers are seeing attain and impression erode from conventional cable tv, they’re centered on transferring to premium streaming content material,” he stated throughout his firm’s earnings name final week. “More and more, that is crucial purchase on the media plan.”

However streaming is not going to be the one matter on the upfronts — the occasions themselves may also be middle stage.

After two years of upfront pitches recorded from executives’ residing rooms, consumers will fly into New York from across the nation. They may shuttle amongst grand venues to observe shows whereas seated alongside their opponents. Some venues are asking for proof of vaccination, whereas masks are a should at some; Disney is requiring a same-day adverse Covid take a look at.

To many networks, internet hosting an in-person upfront was nonnegotiable this 12 months.

“This present can’t be too huge,” Linda Yaccarino, the chairwoman of worldwide promoting and partnerships at NBCUniversal, stated she advised producers of the corporate’s presentation at Radio Metropolis Music Corridor on Monday. “Having everybody within the room collectively, there isn’t any surrogate for that.”

“Each single model and marketer and advertiser is available in for the upfront week,” stated Rita Ferro, the president of Disney promoting gross sales and partnerships. “It’s going to appear and feel very completely different as a result of it is extremely completely different — there’s a lot extra that we’re bringing to the stage.”

Lots of the week’s showcases will eschew an in depth rundown of nightly prime-time schedules and as a substitute provide a extra holistic view of accessible content material platforms.

Mr. Steinlauf, the Warner Bros. Discovery promoting chief, who’s a veteran of a number of many years of upfronts, described modifications that characterize “the most important shift of my profession.” He stated streaming was “the long run, the brand new frontier,” and closely watched athletic occasions had been “the brand new prime time.” Warner Bros. Discovery will make its upfronts debut on Wednesday in entrance of three,500 individuals at Madison Sq. Backyard.

Jo Ann Ross, Paramount’s chief promoting income officer, stated that its occasion on Wednesday would “present a broader look.” She described it as a “coming-out get together as Paramount” for the corporate previously referred to as ViacomCBS.

“It should really feel completely different than what it was up to now,” she stated.

On Tuesday, Disney will abandon its regular upfront house at Lincoln Middle and transfer to an area within the Decrease East Facet at Pier 36. The presentation will function its three streaming platforms — Hulu, ESPN+ and Disney+ — sharing a stage for the primary time. NBC Common will spotlight its technological capabilities, akin to information assortment, whereas additionally drumming up its Peacock streaming platform, regardless that the service already made a pitch earlier this month throughout NewFronts, an occasion for digital firms courting Madison Avenue.

The competitors may imply extra calls for from advertisers, like the power to again out of commitments and decrease thresholds for a way a lot consumers should spend.

“It’s fundamental economics — there at the moment are extra choices accessible to media consumers and so that you’re going to see much more willingness to be versatile,” stated David Marine, the chief advertising officer of the actual property firm Coldwell Banker.

Potential complications for advertisers this 12 months may embody Russia’s conflict in Ukraine, world provide points and steep inflation, in response to Magna. However low unemployment and different indicators of power from the U.S. financial system, together with the approaching midterm elections, are anticipated to feed a surge in advert spending.

How the upfronts handle these issues, together with deeper actions within the business, “might be telling,” stated Katie Klein, the chief funding officer on the company PHD.

“There’s all the time going to be room for the upfront, there’s all the time going to be a necessity for it,” she stated. “However it’s going to evolve as our business is evolving.”