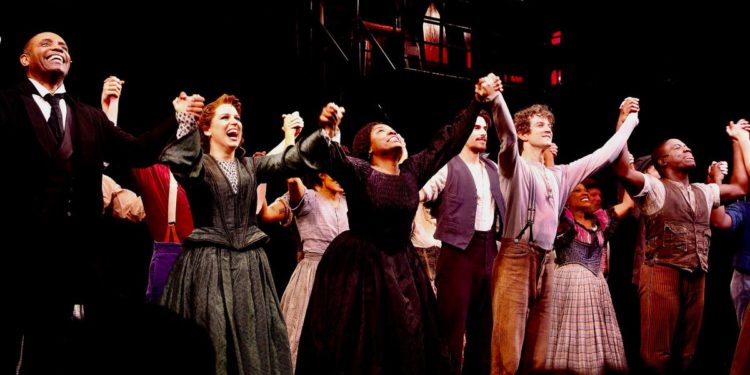

Joaquina Kalukango and the solid of ‘Paradise Sq.’ smiling after the opening night time efficiency at … [+]

Bruce Glikas/Getty Pictures

There may be bother brewing in paradise.

Final week, the producers of the Broadway musical Paradise Sq. filed paperwork with the U.S. Securities and Change Fee to extend its preliminary capitalization prices from $13.5 million to $15 million. The transfer, which comes multiple month after the present opened on the Barrymore Theatre, is perhaps unprecedented.

“I’m not conscious of any present that has completed this,” remarked John Breglio, an lawyer who labored on lots of of performs and musicals for practically 4 many years earlier than turning into a producer. Different theatre attorneys and normal managers with many years of expertise additionally reported by no means seeing something prefer it.

In response to the New York Legal professional Common’s rules, the entire cash for a Broadway present should be within the financial institution on or earlier than “the primary public efficiency of the theatrical manufacturing,” which might ordinarily imply its first preview efficiency. However, a few many years in the past, theatre attorneys made a handshake take care of the federal government to increase the deadline for elevating the preliminary capitalization prices to opening night time.

Consequently, “it’s not very uncommon for producers to be accepting investments throughout rehearsals and even into previews,” observed Jordan Roth, the president of Jujamcyn Theaters, which owns 5 Broadway theaters. Racing towards the clock, Broadway producers typically scramble to seek out the ultimate funds obligatory to finish the preliminary capitalization prices of their exhibits.

One group of buyers, who supplied the cash to complete financing one musical on the final minute, even determined to call their manufacturing firm “Below the Wire.”

Regardless of experiencing some cash flows issues throughout rehearsals, the producers of Paradise Sq. reported that every one of its $13.5 million preliminary capitalization prices had been raised earlier than opening night time. In response to a authorities submitting, 58 financiers had invested within the non-public providing.

Nonetheless, after receiving combined opinions, Paradise Sq. has struggled on the field workplace. The present has not been capable of fill greater than three-fourths of its seats or make greater than $260,000 in ticket gross sales every week because it opened, properly under the $598,500 weekly working prices estimated in its authentic monetary paperwork.

Working within the crimson because it began performances, the musical has doubtless depleted the $1.7 million put aside in its authentic finances to cowl any weekly losses.

However, the crew behind Paradise Sq. doesn’t but suppose that paradise is misplaced.

The musical acquired 10 Tony Awards nominations final week, and demand for tickets to the present spiked on the Broadway ticketing web site TodayTix. “The present is discovering an viewers,” acknowledged its artistic and advertising and marketing producer, Garth Drabinsky.

In an effort to maintain the present working till at the least the Tony Awards subsequent month, the producers are actually growing the quantity of their providing an extra $1.5 million. The probably unprecedented transfer signifies that the Broadway present might search new outdoors buyers, permitting individuals to turn into producers after the present already opened, acquired opinions, and picked up Tony Awards nominations.

Nonetheless, an lawyer for Paradise Sq. confirmed that the musical solely plans to boost cash from its present buyers, and, even when there are any new buyers, then they’d not be thought-about Tony Award-nominated producers. Solely the “producers listed above the title within the opening night time program for a manufacturing along with another producers as could also be authorised by the Tony Awards Administration Committee” are eligible to obtain a nomination, based on the Tony Awards’ rules.

But, Paradise Sq. is perhaps the primary present to ever file paperwork to extend the quantity of its preliminary capitalization prices after opening on Broadway.

Often, when a Broadway present is struggling to outlive, its producers will usually ask members of the artistic crew to scale back, defer, or waive their royalties in an effort to decrease the weekly working prices. The overall supervisor will even usually attempt to trim any bills that aren’t mounted within the finances, such because the promoting prices.

In some instances, some Broadway producers will even put extra money into their exhibits, making a precedence mortgage, which might be repaid earlier than any cash is distributed to the unique buyers.

Nonetheless, the producers of Paradise Sq. didn’t need to marginalize the unique buyers, placing them second in line to the lenders of the precedence mortgage. The restricted partnership settlement for the present already splits the buyers into two lessons, providing a particular bonus to the buyers who bankrolled its $3.2 million out-of-town tryout at Berkeley Repertory Theatre.

Some trade insiders suspected that the rise within the preliminary capitalization prices after the present opened is perhaps related to a so-called “overcall” clause, which permits the producers to require buyers to cough up extra cash equal to typically as a lot as 20% of their authentic investments. The availability isn’t used anymore, as a result of it’s “a horrible thought,” wrote one lawyer.

If a number of the buyers don’t present the extra funding when demanded, then the producer would wish to sue them for the cash. However, along with the appreciable prices of litigation, getting a court docket judgment might take years, and the producer wants the cash now.

As well as, the producer would doubtless burn his bridge with the buyers. “I wouldn’t need anyone coming again to me for extra money, notably when a present’s in bother, and, actually, cash hardly ever impacts the end result,” remarked the late producer, Hal Prince.

Thankfully for the buyers of Paradise Sq., the restricted partnership settlement for the present doesn’t include an overcall provision, and the reason for the baffling transfer lies in one other a part of the complicated authorized doc.

The settlement states that, after the entire cash for the present has been raised, “no further [co-producers] could also be admitted with out the consent of a majority in curiosity of [all of the other co-producers].” However, if the preliminary manufacturing bills of the present earlier than it opens on Broadway are greater than the amount of cash the producers initially raised, then the lead producer can deliver on new producers, and the brand new producers would solely dilute the pursuits and entitlements of the lead producer.

With larger than projected load-in prices, in addition to losses suffered on account of efficiency cancellations because of the COVID-19 pandemic, Paradise Sq. ended up costing extra money than initially deliberate, and the producers determined to boost the preliminary capitalization prices to just accept new investments. Not like with precedence loans, the motion “retains buyers on the identical degree,” reasoned the lawyer for the present.

The musical might definitely use the cash. Along with paying the weekly working prices and the bills related to an promoting marketing campaign for the Tony Awards, the manufacturing was sued for failing to pay its former director of group gross sales final week.

The article was up to date with further data supplied after publication.