Solely 21% of the 12 million registered automobiles on Nigerian roads have real motor insurance coverage, as the remaining both have pretend certificates (homeowners are largely unaware) or aren’t lined in any respect.

This report additionally states that a variety of automobile homeowners holding real insurance coverage insurance policies additionally fail to resume them after they expire, a violation of the regulation in Nigeria, which calls for that each car have to be lined by insurance coverage. All these challenges stem from the truth that most transactions within the business are nonetheless achieved manually and, most frequently, by way of brokers, which additional exacerbates the issues.

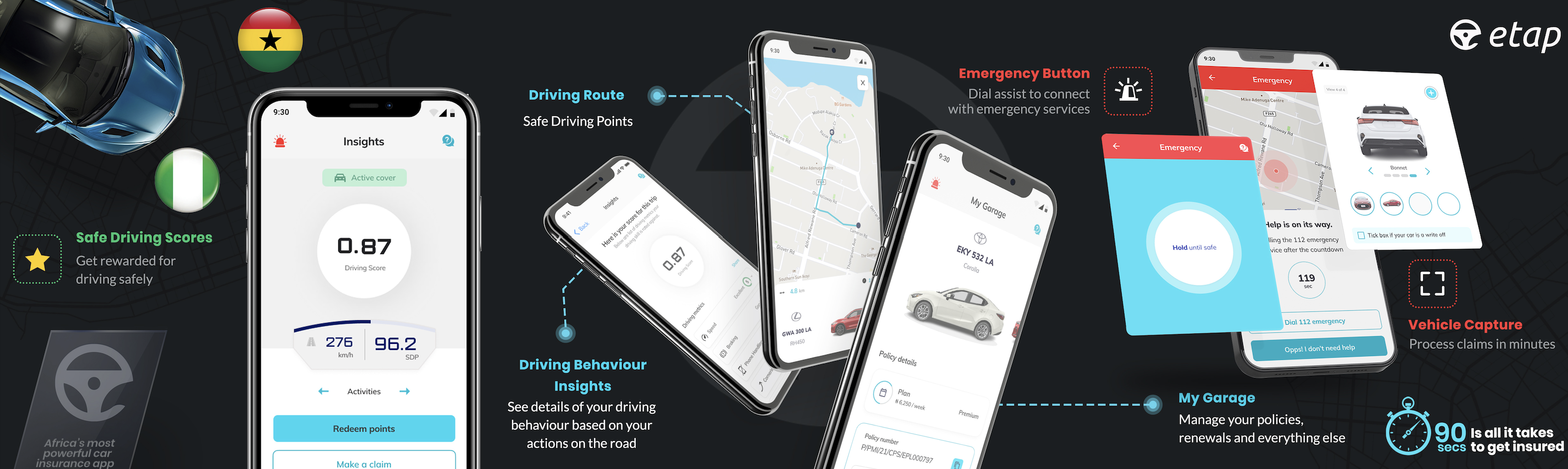

To bridge the hole, insurtechs like Etap have over the previous few years emerged in Nigeria, and throughout Africa, to smoothen the method of shopping for insurance coverage and making claims. Etap declare to allow motorized vehicle homeowners to buy insurance coverage in 90 seconds and full claims in three minutes.

The startup is now on an growth drive throughout the West African nation following a $1.5 million pre-seed funding in a spherical led by Mobility 54; the enterprise capital arm of Toyota Tsusho and CFAO Group.

“We have now nice merchandise and glorious worth propositions. However we all know that the merchandise and worth proposition could be higher and that’s why we sought out companions that we now have proper now. Our plan is to have probably the most most well-liked insurance coverage merchandise and to develop and scale this throughout Africa. I really feel like we’re completely positioned to attain that,” Etap founder and CEO Ibraheem Babalola advised Avisionews.

Tangerine Insurance coverage additionally Etap’s underwriter, Graph Ventures, Newmont and several other different angel buyers participated within the spherical.

Etap declare to allow motorized vehicle homeowners to buy insurance coverage in 90 seconds and full claims in three minutes. Picture Credit: Etap

Babalola began constructing Etap final 12 months annoyed by the complexities and delays concerned in buying insurance coverage. In his personal phrases, he got down to make shopping for insurance coverage and making claims as straightforward as taking an image – therefore the identify Etap.

“The concept itself is from being a annoyed buyer; my insurance coverage would expire and I wouldn’t get a notification to resume it…I at all times needed to make a name to a man who would assist me renew it. I assumed that there’s a strategy to do it higher,” stated Babalola, including that policyholders obtain notifications when their protection expires, and may go for computerized renewal.

Babalola, who has expertise constructing and serving to monetary providers and proptech startups to scale, beforehand labored with an govt of a prime insurance coverage firm in Nigeria, which sparking his curiosity within the sector.

“Nigeria has one of many highest threat environments on the planet and an insurance coverage penetration of lower than 2% — that relationship is loopy as a result of the upper the chance the extra the propensity to need to defend your self towards occasions; however in Nigeria and the remainder of Africa, this isn’t the case. This wants to vary,” stated Babalola.

He added that, “Having all these experiences from being on the 2 sides; being a buyer and near the operator, and expertise in constructing startups; I assumed it’s essential to reimagine insurance coverage — To reimagine the providing, how folks entry it, person expertise — to make it extra versatile, and transparency — by constructing belief and giving folks extra worth.”

The startup launched the beta model of its app in November final 12 months, enabling folks to purchase insurance coverage in keeping with their wants; per journey, every day, month-to-month or yearly. But making the method simpler and versatile isn’t the one driving drive behind Etap’s development; the startup additionally tailors the worth of its merchandise in keeping with driver conduct. They’ve additionally gamified the merchandise too, as prospects earn and redeem factors based mostly on their historical past.

“With our retail distribution, you get profiled based mostly on a bunch of information factors that place you in a threat class,” he stated.

The startup’s end-to-end providers additionally embrace pre-loss inspection (achieved when signing up) and post-accident critiques, all of which is predicated on photographs. To stop fraudulent claims, the app comes with geolocation tags, timestamps and different options like crash notification.

Mobility 54’s venture supervisor, Yumi Takagi stated, “Etap is addressing many challenges that impression the automotive expertise in Africa, and we’re excited to assist and work with them to convey their innovation to extra drivers throughout the continent. We imagine that ETAP will have interaction with this essential position and revolutionize the automotive insurance coverage business with their highly effective know-how.”