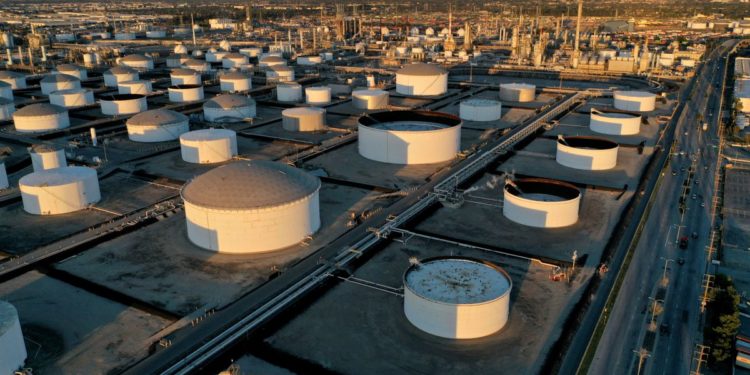

Storage tanks are seen at Marathon Petroleum’s Los Angeles Refinery, which processes home & imported crude oil into California Air Sources Board (CARB), gasoline, diesel gas, and different petroleum merchandise, in Carson, California, U.S., March 11, 2022. Image taken with a drone. REUTERS/Bing Guan

Register now for FREE limitless entry to Reuters.com

NEW YORK, April 21 (Reuters) – Oil costs rose on Thursday, buffeted by considerations about tightened provide because the European Union (EU) mulls a possible ban on Russian oil imports that will additional limit worldwide oil commerce.

Brent crude futures settled up $1.53to shut at $108.33 a barrel, after earlier reaching a excessive of $109.80. U.S. West Texas Intermediate (WTI) crude futures ended up $1.60, or 1.6%, to $103.79, after earlier reaching a excessive of $105.42.

Consumers additionally reacted to ongoing interruptions in Libya, which is dropping greater than 550,000 barrels per day of oil output on account of blockades at main fields and export terminals. learn extra

Register now for FREE limitless entry to Reuters.com

Brent has gained practically 8% within the final seven buying and selling days, however the rally has come at a gradual, grinding tempo, in contrast to the frenzy that accompanied strikes in late February when Russia invaded Ukraine and in mid-March as properly.

“It is not as simple a commerce because it was a few weeks in the past,” stated Phil Flynn, senior analyst at Value Futures Group. “It’s important to threat extra, and which may be by design with these hedge funds and algo funds buying and selling extra.”

The market bought off considerably after U.S. Treasury Secretary Janet Yellen stated on Thursday that the EU must be cautious a few full ban on imports of Russian vitality as a result of it will seemingly trigger oil costs to spike. learn extra

The EU continues to be weighing such a ban over Russia’s invasion of Ukraine, which Moscow calls a “particular army operation” to demilitarise its neighbour. learn extra

Flynn stated the market is weighing the likelihood that, down the highway, slowed progress or further provide might undermine the bullish case for oil. Within the meantime, nevertheless, the market stays tight. U.S. shares of distillate fuels are close to 14-year lows, the U.S. Power Division stated on Wednesday.

Merchants additionally cited feedback from Federal Reserve officers that instructed an aggressive path for growing U.S. rates of interest in coming months. That would drag on progress, lowering demand for vitality merchandise.

U.S. crude exports rose to greater than 4 million barrels a day final week, partially offsetting the losses of Russian crude hit by sanctions from the US and European nations.

The oil market stays tight with the Group of the Petroleum Exporting International locations and allies led by Russia, collectively known as OPEC+, struggling to fulfill their manufacturing targets and with U.S. crude stockpiles down sharply within the week ended April 15. learn extra

“With solely two international locations within the OPEC+ alliance holding vital spare capability, Saudi Arabia and the UAE, the group is sticking to a cautious strategy in unwinding pandemic-related manufacturing cuts,” UBS stated in a notice.

The demand outlook in China continues to weigh available on the market, because the world’s largest oil importer slowly eases strict COVID-19 curbs which have hit manufacturing exercise and world provide chains. learn extra

Register now for FREE limitless entry to Reuters.com

Reporting by David Gaffen Extra reporting by Noah Browning in London, Mohi Narayan in New Delhi and Sonali Paul in Melbourne

Enhancing by Mark Potter and Paul Simao

: .