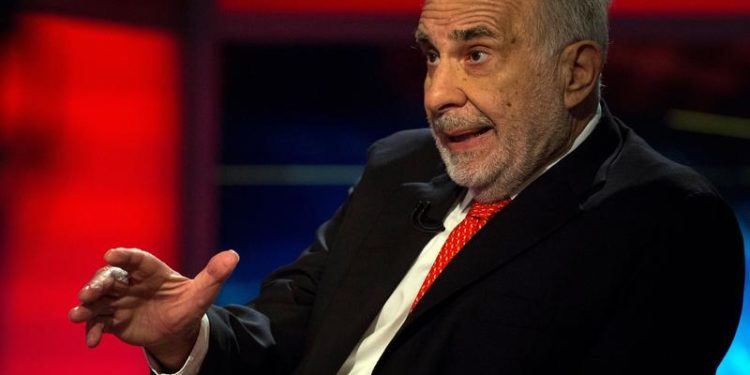

NEW YORK (Reuters) – Southwest Gasoline Holdings reached a settlement on Friday with Carl Icahn that may exchange the corporate’s chief govt and hand as many as 4 board seats to the billionaire investor.

The settlement ends a months-long battle Icahn launched with the Las Vegas, Nevada-based firm in October because it pushed forward with plans to purchase Questar Pipelines for roughly $2 billion.

Southwest Gasoline mentioned it promoted Karen Haller to CEO and president, changing John Hester instantly. Icahn mentioned in an announcement that no settlement would have been reached with out Hester leaving the corporate.

“We’re assured that she is the appropriate chief for Southwest Gasoline shifting ahead,” board chairman Michael Melarkey mentioned in an announcement about Haller.

Icahn will likely be allowed to nominate at the least three administrators after subsequent week’s annual assembly. The corporate mentioned a fourth director will be part of the board if the board decides to not spin off infrastructure companies firm Centuri, a call the corporate introduced in March.

Southwest Gasoline mentioned it’s going to decide about whether or not to spin off Centuri inside 90 days of the settlement.

Icahn, saying the Questar buy would damage shareholders, had sought to take management of the board by making an attempt to switch 10 administrators and pushing for the ouster of the CEO. He referred to as Hester and his administration workforce “an excellent legal responsibility” to the corporate.

The board could have 11 administrators, together with 10 unbiased administrators after the corporate’s annual assembly on Thursday.

Icahn, 86, has spent a profession tangling with firms and historically asks for a number of board seats when he thinks companies needs to be run higher. He typically settles with the corporate after which steps apart as his chosen administrators turn out to be concerned in operations.

On Friday Icahn mentioned in an announcement that he has hardly ever felt the necessity to oust a CEO however that when such a transfer was obligatory, it “virtually all the time vastly enhanced worth for ALL shareholders.” Icahn even provided to purchase the corporate for $82.50 a share.

Final month Southwest mentioned it might contemplate promoting itself, amongst different options, after an unnamed potential purchaser confirmed curiosity in shopping for the corporate at a value “properly in extra” of Icahn’s provide.

Reporting by Svea Herbst-Bayliss; Enhancing by William Mallard