World enterprise capital corporations are pouring cash into the semiconductor startups growing the subsequent technology of chips. Semiconductors, which have turn into a valued asset, are utilized in just about nearly each trade, together with 5G networks, automation, the Web of Issues, financials, sensible houses, sensible cities, digital actuality (VR), augmented actuality and self-driving automobiles.

Sunghyun Park, a former quant developer at Morgan Stanley in New York, launched synthetic intelligence semiconductor startup Rebellions with 4 co-founders to enter this red-hot trade in 2020. In the present day, the South Korea-based firm that builds chips designed for synthetic intelligence purposes, introduced it has raised a $50 million (62 billion KRW) Collection A from traders, together with Temasek’s Pavilion Capital, Korean Improvement Financial institution, SV Funding, Mirae Asset Capital, Mirae Asset Ventures, IMM Funding, KB Funding and KT Funding.

Its current backers Kakao Ventures, GU Fairness Companions and Seoul Techno Holdings additionally participated within the spherical, Park instructed Avisionews.

The Collection A, which was oversubscribed — the agency initially focused round $40 million — and wrapped up in lower than three months, brings Rebellions’ complete funding raised to about $80 million (100 billion KRW) at an estimated valuation of $283 million (325 billion KRW), CEO of Rebellions Park stated in an interview with Avisionews.

The startup will use the capital to mass-produce its second AI chip prototype, known as ATOM, which can be utilized in enterprise servers, Park stated. Moreover, the funding can be used to double its headcount to 100 staff, and arrange an workplace within the U.S. by the top of this 12 months, Park continued.

Rebellions is in talks with potential clients to get its first AI Chip, known as ION, into the market. The corporate’s ION clients may embody international funding banks, and its second chip ATOM targets massive firms within the cloud sector and information facilities, Park added. It has lined up Taiwan Semiconductor Manufacturing Firm (TSMC) to start manufacturing the ION chips as early as subsequent 12 months.

The corporate claims that its first chip ION, launched in November 2021, improves buying and selling speeds and reduces latencies and is 2 occasions quicker than Intel Habana Labs’ AI Chip Goya when it comes to execution. Which means Rebellions’ ION allows quicker information execution, in order that lead orders could be processed extra rapidly and profitably than merchants with slower execution speeds. Excessive-frequency buying and selling (HFT), or systematic buying and selling, is an automatic buying and selling platform utilized by massive funding banks, hedge funds and institutional traders to transact a lot of orders.

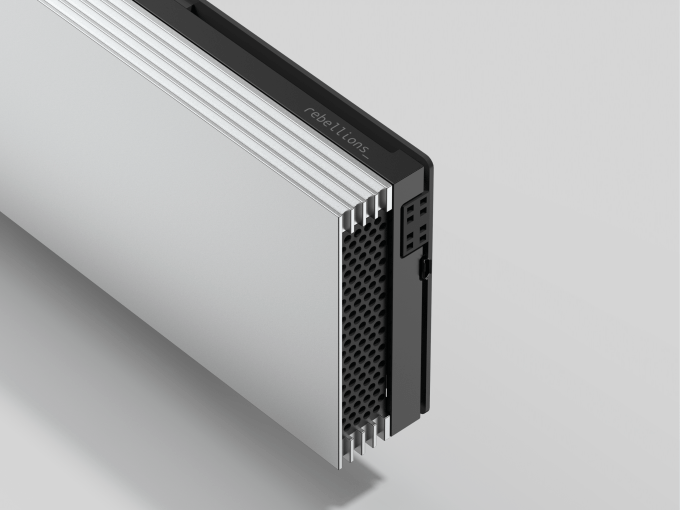

Picture Credit: Rebellions’ AI chip ION

Park had beforehand helped design a Starlink ASICs chip at SpaceX, and labored as an engineer at Intel Labs and Samsung Electronics.

There are greater than 50 AI chip makers on the planet, together with Samba Nova, Graphcore, Groq and Cerebras, trying to problem AI processors from Nvidia, Intel and Qualcomm, in response to Gartner analyst Alan Priestley. Intel acquired Israeli AI chipmaker Habana Labs for about $2 billion in 2019 whereas Qualcomm picked up Nuvia for about $1.4 billion in early 2021. The AI chip market is projected to be value over $83.2 billion by 2027, up from $56 billion in 2018, per a 2019 report by Perception Companions.

Enterprise capital funding for international chip startups more than tripled 12 months over 12 months in 2021, with $9.9 billion invested throughout 170 offers, per PitchBook.