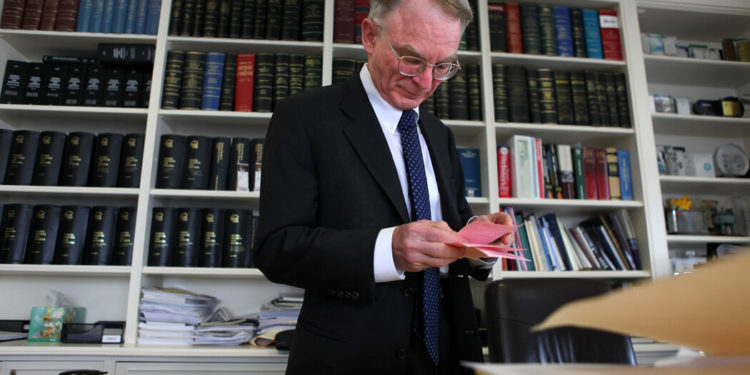

Key adviser

There are many variations between the fallout from the collapse of Silicon Valley Financial institution and the 2008 monetary disaster, however one similarity is the person attempting to scrub it up: H. Rodgin Cohen, generally known as Rodge, the senior chair on the regulation agency Sullivan & Cromwell.

The soft-spoken Mr. Cohen was on the middle of efforts to avoid wasting Silicon Valley Financial institution and First Republic, the latter of which concerned a name between the Federal Reserve chair Jerome Powell, Treasury Secretary Janet Yellen and the JPMorgan Chase boss Jamie Dimon. Right here’s what to find out about one of the vital influential gamers within the banking disaster who isn’t making headlines.

Mr. Cohen is a sought-after adviser in banking crises, and he has labored on nearly each one within the final a number of many years. “Rodge is the banking lawyer’s go-to — there’s no one who comes near his stage of reliability in the whole realm of substantive banking regulation,” stated Sarah Raskin, a former deputy secretary of the Treasury. She added that she nonetheless finds herself in rooms of attorneys asking, “What would Rodge say?”

Mr. Cohen additionally as soon as performed a task in a global disaster: In the course of the Iran-contra affair, he suggested the American banks that launched Iranian funds as a situation to free the American hostages.

He’s been at Sullivan & Cromwell for greater than 50 years. After a run on Continental Illinois Financial institution compelled a authorities seizure in 1984, Mr. Cohen led its negotiations with the F.D.I.C. He represented the Financial institution of New York in its $1.48 billion bid for Irving Financial institution, one of many first hostile takeovers of a financial institution, in 1988.

In the course of the 2008 monetary disaster, he represented both the customer or the vendor in practically each main financial institution deal, together with the government-backed sale of Washington Mutual to JPMorgan Chase. He was in such sturdy demand that he went from advising Lehman Brothers earlier than it collapsed to counseling Barclays, which purchased up a considerable a part of the agency, after it fell. “Each time I seemed up, it appeared like Rodge was within the room,” Henry Paulson, the previous Treasury secretary, informed The Occasions in 2009.

This disaster could require new maneuvers. Mr. Cohen suggested Silicon Valley Financial institution because it scrambled for a purchaser and has been counseling First Republic because it clamors for a lifeline. (The financial institution’s transfer to inject some $30 billion in capital from 11 banks was a web page from a well-tested playbook of joint intervention, together with for Continental Illinois.)

However as First Republic continues to teeter — and questions swirl in regards to the extent of presidency intervention — the query now for First Republic and others is what the 2023 playbook will appear to be. If previous patterns proceed, Mr. Cohen can have a task in writing it. — Lauren Hirsch

IN CASE YOU MISSED IT

A dangerous emptiness. Silicon Valley Financial institution operated and not using a chief danger officer for a lot of the final 12 months, reports The Wall Street Journal. The job is among the many business’s most thankless, however SVB’s collapse underscores how a lot it issues.

Revenue motive. Elon Musk reduce off funding to OpenAI in 2018, leaving it and not using a technique to pay for the costly job of coaching its A.I. fashions on supercomputers, reviews Semafor. Quickly after, the corporate introduced that it will create a for-profit entity.

Palm fee. JPMorgan Chase plans to check new expertise that will enable shoppers to pay with their palms or faces at some U.S. retailers. The financial institution, one of many world’s largest fee processors, expects the expertise to account for $5.8 trillion in transactions by 2026.

A.I. on A.I. Reid Hoffman, the LinkedIn co-founder, wrote a book about artificial intelligence with the assistance of GPT-4, the newly launched language mannequin from Open AI, which Hoffman has funded.

Is that this a ‘Minsky second’?

“Minsky second” final entered the zeitgeist during the 2008 financial crisis, and a few pundits are actually placing it to make use of to touch upon the present banking disaster. It describes the purpose after a protracted bull run when it turns into clear that asset values are unsustainable and an epic crash looms.

The again story: The time period was coined by the economist Paul McCulley in 1998 as asset bubbles burst and is predicated on the “financial instability hypothesis” of the economist Hyman Minsky. His speculation holds that over a protracted interval of prosperity, buyers tackle rising danger till lending exceeds what debtors can repay they usually begin promoting protected property, resulting in plunging markets and making a money crunch.

Does the phrase apply to what’s occurring proper now? Most likely not. SVB didn’t fall as a result of it was overleveraged — fairly, fleeing depositors compelled it to promote property at deflated values, so technically SVB was not a Minsky moment, writes Zongyuan Zoe Liu, an financial coverage fellow on the Council on Overseas Relations. However analysts at JPMorgan see a possible Minsky moment forward as rates of interest rise and financial engines sputter, citing issues about world banking woes amongst different indicators.

14 p.c

— The decline in Chinese billionaires last year because the ultrarich paid for China’s zero-Covid coverage, a regulatory crackdown on personal enterprise and a property collapse.

Switzerland worn out Credit score Suisse bondholders, and it’s an enormous deal

When the Swiss authorities compelled the wedding of UBS and Credit score Suisse, it wrote down about $17 billion of the latter’s bonds and prioritized shareholders over bondholders, writes The Occasions’s Joe Rennison, upending the same old order of who takes losses first in a chapter. Within the phrases of the Commonplace Chartered C.E.O. Invoice Winters, that might have “profound” implications for the way banks are run and for world regulation.

The deal focused an obscure a part of the debt market. Further tier one, or AT1, bonds, are issued by many European banks. They rely towards their capital necessities as a result of in confused conditions, they are often written off and transformed into fairness to assist hold the financial institution from failing.

The Swiss regulator Finma defended the decision to put in writing down Credit score Suisse’s AT1 bonds, saying it was essential to “shield shoppers, the monetary middle and markets.” Finma added that AT1 bonds embrace contractual language that they are often “written down in a viability occasion,” if the federal government offers it the authority to take action.

However after the write-down, the AT1 bonds at different European lenders, together with Barclays, Commonplace Chartered and BNP Paribas, all fell sharply regardless that E.U. regulators stated they’d adhere to the standard hierarchy of who advantages first within the case of a chapter and fairness holders would take the primary hit. As worries swirled round Deutsche Financial institution, sending its share down as a lot as 15 p.c yesterday, its bonds additionally fell. One greenback bond dropped from 96 cents on the euro firstly of the month to lower than 70 cents yesterday.

Winters says the Swiss transfer may change how banks are assessed, as a result of Credit score Suisse’s bonds had been worn out regardless that the financial institution was solvent. “The difficulty isn’t do the regulators have faith in our solvency. It’s does the market have faith in our liquidity?” he informed a convention in Hong Kong.

Bondholders could take authorized motion. The regulation companies Quinn Emmanuel and Parras Companions are vying to signify specialist buyers like Centerbridge and Davidson Kempner, in addition to conventional fund managers like Pimco and Invesco. However they don’t have lengthy to argue their level: Motion must be taken inside 30 days of the deal, in keeping with individuals accustomed to the method.

On our radar: The ultimate season of ‘Succession’

The fourth and final season of “Succession” begins tomorrow. With all of the current drama among the many real-life Murdochs — the 92-year-old Rupert saying his plans for a fifth marriage ceremony, a $1.6 billion defamation lawsuit, and a failed try and merge two elements of an enormous media empire — you could have not missed the fictional media dynasty that bears greater than a slight resemblance to the household. However early evaluations recommend “Succession” is value watching — particularly given the promise of an precise conclusion. The Guardian referred to as it “TV’s most agonising, pulverising drama” (which appears to be a praise). Vogue says it’s “a lightning strike,” and Rolling Stone wrote, “It’s full steam forward to the tip.”

Thanks for studying!

We’d like your suggestions. Please e-mail ideas and recommendations to dealbook@nytimes.com.