The Federal Reserve is poised to set out a path to quickly withdraw assist from the economic system at its assembly on Wednesday — and whereas it hopes it might include inflation with out inflicting a recession, that’s removed from assured.

Whether or not the central financial institution can gently land the economic system is more likely to function a referendum on its coverage method over the previous two years, making this a tense second for a Fed that has been criticized for being too sluggish to acknowledge that America’s 2021 value burst was turning right into a extra major problem.

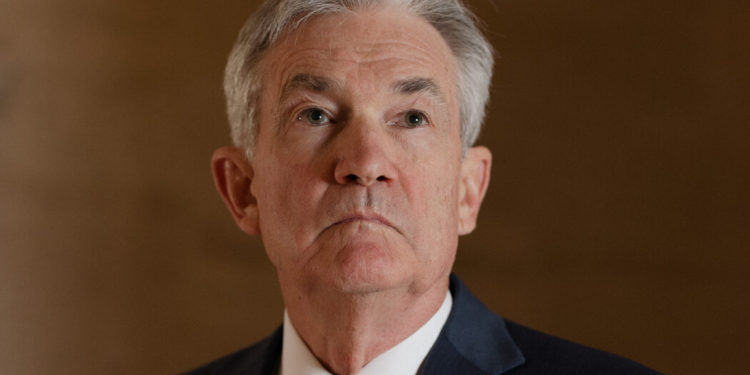

The Fed chair, Jerome H. Powell, and his colleagues are anticipated to boost rates of interest half a proportion level on Wednesday, which might be the biggest improve since 2000. Officers have additionally signaled that they may launch a plan for shrinking their $9 trillion steadiness sheet beginning in June, a coverage transfer that can additional push up borrowing prices.

That two-front push to chill off the economic system is anticipated to proceed all year long: A number of policymakers have stated they hope to get charges above 2 p.c by the top of 2022. Taken collectively, the strikes may show to be the quickest withdrawal of financial assist in a long time.

The Fed’s response to scorching inflation is already having seen results: Climbing mortgage charges appear to be cooling some booming housing markets, and inventory costs are wobbling. The months forward may very well be risky for each markets and the economic system because the nation sees whether or not the Fed can sluggish fast wage progress and value inflation with out constraining them a lot that unemployment jumps sharply and progress contracts.

“The duty that the Fed has to tug off a comfortable touchdown is formidable,” stated Megan Greene, chief international economist on the Kroll Institute, a analysis arm of the Kroll consulting agency. “The trick is to trigger a slowdown, and lean in opposition to inflation, with out having unemployment tick up an excessive amount of — that’s going to be tough.”

Optimists, together with many on the Fed, level out that that is an uncommon economic system. Job openings are plentiful, customers have constructed up financial savings buffers, and it appears attainable that progress will probably be resilient at the same time as enterprise circumstances sluggish considerably.

Perceive Inflation within the U.S.

However many economists have stated cooling value will increase down when labor is in demand and wages are rising may require the Fed to take vital steam out of the job market. In any other case, companies will proceed to cross rising labor prices alongside to clients by elevating costs, and households will keep their potential to spend because of rising paychecks.

“They should engineer some type of progress recession — one thing that raises the unemployment fee to take the stress off the labor market,” stated Donald Kohn, a former Fed vice chair who’s now on the Brookings Establishment. Doing that with out spurring an outright downturn is “a slender path.”

Fed officers minimize rates of interest to near-zero in March 2020 as state and native economies locked all the way down to sluggish the coronavirus’s unfold initially of the pandemic. They saved them there till March this 12 months, once they raised charges 1 / 4 level.

However the Fed’s balance-sheet method has been the extra widely criticized policy. The Fed started shopping for government-backed debt in large portions on the outset of the pandemic to calm bond markets. As soon as circumstances settled, it purchased bonds at a tempo of $120 billion, and continued making purchases even because it grew to become clear that the economic system was therapeutic extra swiftly than many had anticipated and inflation was excessive.

Late-2021 and early-2022 bond purchases, that are what critics are likely to give attention to, got here partly as a result of Mr. Powell and his colleagues didn’t initially suppose that inflation would turn out to be longer lasting. They labeled it “transitory” and predicted that it might fade by itself — consistent with what many private-sector forecasters anticipated on the time.

When provide chain disruptions and labor shortages endured into the autumn, pushing up costs for months on finish and driving wages greater, central bankers reassessed. However even after they pivoted, it took time to taper down bond shopping for, and the Fed made its final purchases in March. As a result of officers most popular to cease shopping for bonds earlier than lifting charges, that delayed the entire tightening course of.

The central financial institution was making an attempt to steadiness dangers: It didn’t wish to rapidly withdraw assist from a therapeutic labor market in response to short-lived inflation earlier in 2021, after which officers didn’t wish to roil markets and undermine their credibility by quickly reversing course on their steadiness sheet coverage. They did pace up the method in an try to be nimble.

“In hindsight, there’s a extremely good probability that the Fed ought to have began tightening earlier,” stated Karen Dynan, an economist on the Harvard Kennedy College and a former Treasury Division chief economist. “It was actually laborious to guage in actual time.”

Nor was the Fed’s coverage the one factor that mattered for inflation. Had the Fed begun to tug again coverage assist final 12 months, it may need slowed the housing market extra rapidly and set the stage for slower demand, however it might not have fastened tangled provide chains or modified the truth that many customers have more cash on hand than usual after repeated authorities reduction checks and months spent at house early within the pandemic.

Inflation F.A.Q.

What’s inflation? Inflation is a lack of buying energy over time, that means your greenback is not going to go as far tomorrow because it did in the present day. It’s sometimes expressed because the annual change in costs for on a regular basis items and companies akin to meals, furnishings, attire, transportation and toys.

“I believe it might look considerably totally different,” Mr. Kohn, who has been important of the Fed’s slowness, stated of the economic system had it reacted sooner. “Wouldn’t it look rather a lot totally different? I don’t know.”

Nonetheless, the gradual reorientation away from simple financial coverage may give inflation the time to turn out to be a extra everlasting function of American life. As soon as fast value positive aspects are embedded, they could show tougher to eradicate, requiring greater charges and presumably a extra painful improve in unemployment.

For now, longer-term consumer inflation expectations have remained pretty regular, although short-term expectations have surged. The Fed is transferring quickly now to keep away from a scenario through which inflation adjustments expectations and conduct extra lastingly.

James Bullard, the president of the Federal Reserve Financial institution of St. Louis, has even steered that officers may take into account a 0.75-point fee improve — although his colleagues have signaled little urge for food for such a big transfer at this assembly.

Michael Feroli, chief U.S. economist at J.P. Morgan, stated in a analysis notice that whereas “it’s fairly clear that this economic system doesn’t want stimulative financial coverage,” he didn’t anticipate the Fed to boost rates of interest by that a lot, particularly as a result of it tended to broadcast its strikes forward of time.

“But when there’s a time to interrupt from behavior, it’s when the Fed’s inflation credibility is being known as into query, and so we don’t write off the potential for a bigger fee transfer,” he stated.

What occurs subsequent with inflation and the economic system will rely partly on elements far past the central financial institution’s management: If provide chains heal and factories catch up, rising costs for vehicles, tools, couches and clothes may reasonable on their very own, and the Fed’s insurance policies wouldn’t should do as a lot to sluggish demand.

Many economists do anticipate inflation to peak within the months forward, although it’s unclear how lengthy it’ll take for it to return again down from March’s 6.6 p.c studying to one thing extra consistent with the two p.c annual fee the Fed targets on common over time — or whether or not that’s attainable with out job market ache and a recession.

Treasury Secretary Janet L. Yellen, a former Fed chair, summed up the situation this fashion final month: “It’s not an unattainable mixture. However it’ll require talent and in addition good luck.”

Liverpool breaks two record with Villarreal win

Liverpool breaks two record with Villarreal win