Wall of fear

The U.S. inventory market, as measured by the S&P 500, tumbled greater than 3 % yesterday, dragging it deeper into bear market territory. This morning, futures markets recommend there can be a rebound, however the S&P remains to be properly on observe to report its tenth weekly decline of the previous 11 weeks.

Bull markets are sometimes stated to climb a wall of fear, with occasional slips alongside the best way. When bear markets rappel, there are additionally periodic pauses for breath. That has been the theme of late, with traders veering from reduction that policymakers are taking aggressive actions to rein in inflation to concern in regards to the impact these actions might have on financial progress.

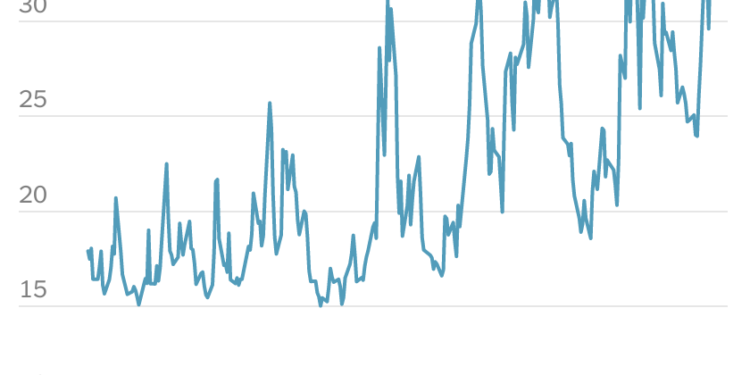

Among the finest bets just lately has been volatility. The VIX volatility index, which is usually referred to as the “concern index” as a result of it tracks traders’ demand for a sort of monetary instrument that provides safety towards market drops, has greater than doubled previously 12 months, to properly over 30. The index had fallen to round 15 at occasions through the second half of final 12 months, its lowest degree because the begin of the pandemic.

The explanations for the inventory market’s downward lurches are properly established at this level:

A mix of provide chain points and a sizzling financial system has prompted costs to surge.

With a view to struggle inflation, the Fed is elevating rates of interest aggressively.

Traders are frightened that the Fed’s efforts will tip the financial system into recession.

There’s additionally a lingering pandemic, and a struggle in Europe.

The inventory market itself could be an financial concern, too. In all, the drop in shares this 12 months has erased about $12 trillion in worth from traders’ portfolios. That’s already greater than the $8 trillion decline in 2008, throughout essentially the most extreme monetary disaster in a century, though on a proportion foundation the 2008 drop was greater. Over time, the rise and fall of shares can propel and drag the financial system through one thing economists name the wealth impact — when folks really feel poorer, even when their losses are totally on paper, they might not spend as a lot, denting the financial system.

Analysts say the market isn’t more likely to get better till there are indicators that inflation is below management. Decrease inflation would, in flip, take strain off the Fed and different central banks to boost charges rapidly, reversing the unfavourable suggestions loop the market and the financial system appear to be caught in.

For now, traders are betting that volatility is right here to remain. Usually, when the VIX spikes, bets on the place the index will commerce a number of months sooner or later are a lot decrease than the present degree. That’s not the case now. Traders are at the moment betting the VIX will finish the 12 months at slightly below 30, down solely barely from right this moment, and far increased than the longer-term development. The VIX has averaged about 20 over the previous 5 years.

The State of the Inventory Market

The inventory market’s decline this 12 months has been painful. And it stays tough to foretell what’s in retailer for the longer term.

HERE’S WHAT’S HAPPENING

The Jan. 6 committee hearings concentrate on all of the president’s males. A prime lawyer for former vice chairman Mike Pence stated Donald Trump and the lawyer John Eastman had been informed Trump’s plan to overturn the 2020 election was unlawful. In one other twist, YouTube deleted a portion of the listening to uploaded by the Jan. 6 committee that centered on lies Donald Trump unfold, saying the committee was spreading misinformation.

Russia places the financial squeeze on European leaders in Ukraine. Because the heads of state of Germany, France and Italy met with President Volodymyr Zelensky of Ukraine, Russia minimize flows to Europe’s most necessary pure fuel pipeline. The lower in provide is raising prices, and Russia hinted there can be extra provide reductions to come back.

SpaceX fires staff who helped write and distribute a letter denouncing Elon Musk. Gwynne Shotwell, SpaceX’s president and chief working officer, stated in an electronic mail to staff that the method of making and circulating the letter, which referred to as Musk’s conduct a “distraction and embarrassment,” “made staff really feel uncomfortable, intimidated and bullied.”

Regulators examine the crypto lender Celsius amid its meltdown. The corporate is dealing with questions from securities regulation enforcers in five states whereas scrambling to stay solvent. Celsius’s earlier backers have reportedly informed the corporate, which has frozen withdrawals, that they can’t help. A rising crypto crash has prompted heavy losses for particular person {and professional} traders.

Michel David-Weill, the previous chairman of Lazard, has died at 89, the agency stated. David-Weill was liable for uniting Lazard within the Eighties, combining three impartial partnerships in London, New York and Paris. “Michel’s presence, management and imaginative and prescient outlined Lazard right this moment,” the financial institution’s C.E.O. Ken Jacobs informed DealBook, calling David-Weill an “glorious skeptic of standard knowledge.”

Is the chapter stampede coming?

Revlon, the 90-year-old cosmetics model recognized for its signature shades of lipstick, filed for chapter yesterday. The corporate has struggled to cope with its $3.8 billion mountain of debt. Among the elements that led to the chapter had been explicit to Revlon, like debt-fueled deal-making led by the company raider Ron Perelman, and a model that did not compete towards youthful, hipper rivals. However others, advisers inform DealBook, are a harbinger of bankruptcies to comply with. We hear bankers are already gearing up for what could possibly be a busy fall for individuals who concentrate on distressed debt and exercises.

Most of the bankruptcies we anticipated in 2020 didn’t occur. Plenty of retailers that had been already teetering toppled rapidly into chapter 11, like JCPenney and Neiman Marcus. However the Fed’s infusion of money sustained firms that many anticipated to file for Chapter 11. (And sure industries, like airways, had been buffered by authorities bailouts.) Company chapter filings really fell 5 percent in 2020 and almost 34 percent in 2021. Some specialists warned of a proliferation of zombie companies — firms that make simply sufficient cash to outlive — and a subsequent drag on the broader financial system. On the similar time, these firms and others continued to rack up debt. U.S. company bond issuance neared $2 trillion in 2020.

To date this 12 months, defaults on U.S. company debt are 40 % decrease than final 12 months, based on S&P International. There have been solely 15 so far. However there are indicators this would possibly quickly change. The “misery ratio” — the proportion of the junk bond market that S&P says is displaying indicators of stress — almost doubled over the past month to 4.3 % from 2.4 %, the largest month-to-month leap since March 2020. (That’s nonetheless low in comparison with historic averages.) And this week alone, traders withdrew $6.6 billion from funds that purchase U.S. high-yield bonds, making it the worst week for company bonds since March 2020.

Excessive inflation, rising rates of interest and extra cautious shoppers might add to the misery. So too will provide chain snarls, that are significantly difficult for firms with out the monetary flexibility to pay extra for a scarce product, or to construct and deplete stock as wanted. Retailers can be significantly weak, given the heavy debt load that many are grappling with, together with the decorations and festivities chain Social gathering Metropolis and the division retailer Belk. (And one has to wonder if the just lately proposed debt-fueled acquisition of the Kohl’s division retailer chain is de facto a good suggestion.)

“You’ll be able to positively inform the distinction from the start of the 12 months, when all people was nonetheless form of freaked out from the most recent variant. This summer season goes to leap off.”

— Jason Moore, the overall supervisor of Everson Royce Bar in Los Angeles. Staff’ return to workplaces has additionally led to a rebound within the post-work custom of blissful hour.

What a feud in professional golf says about competitors

LIV Golf, a golf sequence lavishly funded by Saudi Arabia, is feuding with the PGA Tour, which has suspended 17 of its gamers for collaborating within the upstart league. Neither antagonist arouses a lot sympathy, writes Peter Coy, our colleague from Instances Opinion who writes a e-newsletter for subscribers, however the battle does elevate an attention-grabbing financial query: Can restraint of commerce ever be a great factor? We talked to Peter about what golf’s battle royale can inform us in regards to the state of competitors coverage.

DealBook: Ought to the federal government step in to cease the PGA from banning golfers who be part of the LIV?

Peter Coy: I believe it’s somewhat quickly for that. This can be a household feud and the gamers want time to type issues out amongst themselves. If there’s a lawsuit I’d assume it will be filed by golfers, or perhaps by LIV Golf. In the event that they don’t see a cause to sue, it’s arduous to see why the federal government would need to step in.

Do the antitrust questions that come up from the PGA-LIV conflict apply to the talk about whether or not Fb, Google and different Large Tech firms ought to be thought-about monopolies and damaged up?

Clearly there are large variations between golf and tech however a few of the underlying ideas are the identical. Most antitrust instances are determined primarily based on the “rule of cause.” A corporation that’s accused of anticompetitive conduct, whether or not it’s the PGA Tour or Google, can get out of hassle by displaying that its actions are affordable and truly profit shoppers.

The Biden administration has, partly, pointed to the current rise in inflation as proof that firms have an excessive amount of energy to boost costs. Does the golf business help that thesis?

Typically I agree that competitors brings down costs, however on this case, the connection is tough to see. I don’t think about that the 2 teams would compete by reducing the costs they cost the TV networks, match sponsors and so forth. Actually, the competitors between them is leading to a lot greater payouts to golfers. I’d anticipate the golfers to splash out their newfound wealth on automobiles and boats. This could possibly be a bizarre case the place competitors raises inflation.

THE SPEED READ

Offers

Coverage

Importers warn of extra supply delays from a brand new pressured labor regulation focusing on China. (Politico)

A shock Treasury tax windfall might intervene with plans to boost charges for the wealthy. (Politico)

Three environmental teams sued the Biden administration for granting hundreds of fossil gas drilling permits. (The Hill)

“Forty-nine states preordered vaccine doses for very younger kids. Florida didn’t.” (NYT)

Better of the remainder

We’d like your suggestions! Please electronic mail ideas and recommendations to dealbook@nytimes.com.