Shares of Twitter fell greater than 11 p.c by the shut of buying and selling on Monday, as buyers anticipated a doubtlessly drawn-out authorized battle between the social media firm and Elon Musk over his transfer to scrap a deal to purchase the corporate.

Mr. Musk reached an settlement to purchase Twitter for $44 billion about three months in the past. On Friday, after the market had closed, he tried to again out of the legally binding acquisition settlement, claiming that Twitter had not supplied the knowledge essential to calculate the variety of spam accounts on the platform.

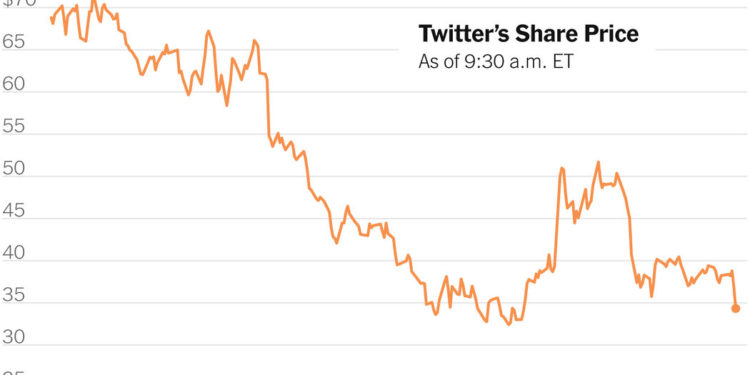

Twitter’s inventory has misplaced a couple of third of its worth since April 25, when the corporate’s board accepted Mr. Musk’s provide. Because the deal was signed, buyers have grown more and more skeptical that the acquisition by the mercurial billionaire would get completed on the agreed phrases. Twitter’s shares have been buying and selling beneath the $54.20 worth supplied by Mr. Musk, and properly bellow the highs above $70 it hit final 12 months.

Mr. Musk has been sparring with Twitter executives for months over his request to acquire details about the way it detects and counts spam accounts on the platform. He has even expressed his displeasure on-line, going so far as to tweet a poop emoji at Parag Agrawal, the corporate’s chief government, in response to his tweet explaining how Twitter detects spam accounts. Specialists have mentioned Mr. Musk’s reasoning will not be legally sound and consider his give attention to false accounts could also be a tactic to cut price for a decrease buy worth.

In Could, Mr. Musk mentioned shopping for Twitter at a lower cost was “not out of the query” throughout a expertise convention in Miami. Bret Taylor, Twitter’s chairman, tweeted on Friday that the corporate’s board was decided to shut the deal “on the value and phrases agreed upon with Mr. Musk” and planning to take authorized motion in opposition to him.