The U.S. financial system powered by way of June with broad-based hiring on par with current months, holding the nation away from recession territory whilst inflation eats into wages and rates of interest proceed to rise.

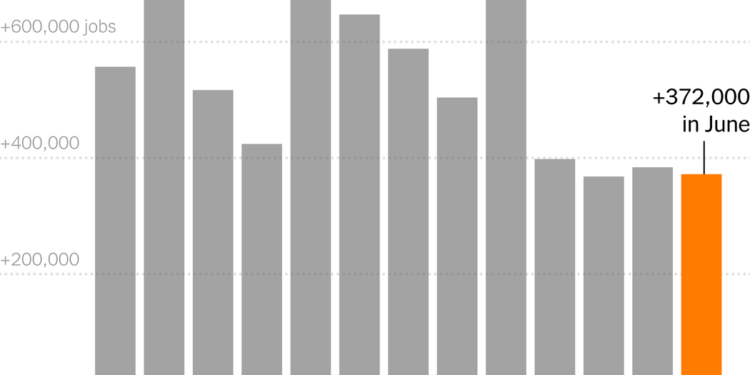

Employers added 372,000 jobs, the Labor Division reported Friday, and the unemployment charge, at 3.6 %, was unchanged from Could and close to a 50-year low.

Washington and Wall Avenue had keenly awaited the brand new knowledge after a collection of weaker financial indicators. The June job progress exceeded economists’ forecasts by roughly 100,000, providing some reassurance {that a} sharper downturn isn’t underway — no less than not but.

However the power of the report, which additionally confirmed larger wage good points than anticipated, may give the Federal Reserve extra leeway for robust medication to beat again inflation. Now, all eyes will likely be watching whether or not the Fed’s technique of elevating rates of interest pushes the nation right into a recession that inflicts harsh ache.

Employment progress during the last three months averaged 375,000, a strong displaying although a drop from a month-to-month tempo of 539,000 within the first quarter of this yr. Employers have continued to hold on to employees in current months, with preliminary unemployment claims rising solely barely from their low level in March.

The personal sector has now regained its prepandemic employment stage — an achievement trumpeted by the White Home on Friday — although the extent remains to be beneath what would have been anticipated absent the pandemic. Apart from the general public sector, no broad industry lost jobs in June, on a seasonally adjusted foundation.

“We’ve primarily floor our approach again to the place we have been pre-Covid,” stated Christian Lundblad, a professor of finance on the Kenan-Flagler Enterprise College on the College of North Carolina. “So, this doesn’t essentially appear like a dire scenario, even supposing we’re fighting inflation and financial declines in another dimensions.”

Robust demand for employees can be evident within the 11.3 million jobs that employers had open in Could, a quantity that continues to be near document highs and leaves practically two jobs obtainable for each particular person searching for work. On this equation, any employees laid off as sure sectors come beneath pressure usually tend to discover new jobs rapidly.

The Labor Division’s broadest measure of labor pressure underutilization — which incorporates part-time employees who need extra hours and individuals who have been discouraged from job searching — sank to its lowest charge because the family survey took its present kind in 1994, an indication that employers are maximizing their current work pressure as hiring stays tough.

Employment in service-providing industries led the June good points, consistent with a pullback in items spending as customers shifted towards experiences that they needed to forgo whereas public well being restrictions remained in place. Leisure and hospitality companies, nonetheless catching as much as prepandemic employment ranges, added 67,000 jobs.

Authorities employment was an exception to the bigger development, with a decline of 9,000 jobs. It was 664,000 jobs beneath the place it stood in February 2020.

The colourful job market has been significantly useful for traditionally marginalized teams: The unemployment charge for Black Individuals sank to five.8 %, nonetheless practically double that for white folks however the lowest it has been since November 2019.

The State of Jobs in the USA

Job good points proceed to keep up their spectacular run, easing worries of an financial slowdown however complicating efforts to struggle inflation.

The wholesome tempo of hiring stands in stark distinction to surveys of consumer and business sentiment, which have sunk to alarmingly lows in current months. Whereas widespread perceptions of being in a recession seem like off base, the swift job progress of the primary half of the yr almost certainly received’t proceed into the second.

Sky-high costs are weighing on shopper spending. Financial savings are shrinking. The labor pressure stays constrained by getting old demographics, low ranges of immigration and boundaries to work — akin to the supply of care for kids and older relations — that preserve many individuals on the sidelines.

In a single regarding sign, the share of individuals within the prime of their careers — from 25 to 54 years outdated — who’re both working or searching for work dropped in June to 82.3 % from 82.6 %, properly beneath the prepandemic excessive of 83.1 %.

The report contained indicators that Covid-19 remains to be a lingering fear, with 2.1 million folks saying they couldn’t work in June as a result of their employer closed or misplaced enterprise on account of the pandemic, in contrast with 1.8 million the earlier month. Additionally, as inflation stays excessive, some folks could also be retreating from the job market just because it’s too costly to maintain working.

That’s the scenario dealing with Megan Petersen, who helps her household of 4 in Spokane, Wash., with a full-time job in digital advertising and marketing and a side business promoting jewellery. Her husband labored for the U.S. Postal Service till final week, when he give up to maintain their 2-year-old after the value of gasoline and the price of little one care exceeded his take-home pay.

“As soon as the advantages and every part come out of your paycheck, it’s actually lower than these two issues mixed,” Ms. Petersen stated. “This doesn’t make mathematic sense.”

Her husband could return to work, she stated, when their youthful daughter enters faculty. However there’s no assure an abundance of jobs will await him. The consulting agency Oxford Economics initiatives that the financial system will add a mean of solely 65,000 jobs per 30 days in 2023.

Enterprise leaders report that, whereas some provide chain points have eased, new orders are slowing. At any time when attainable, employers are automating duties quite than hiring.

“Employers are getting much less anxious to fill these job postings as they watch the financial system sluggish,” stated Invoice Adams, the chief economist at Comerica Financial institution. “I might anticipate that most likely companies will slow-walk filling open positions earlier than they really pull job postings.”

Wage progress, whereas sturdy, moderated in June, and it was not sufficient to maintain tempo with costs, which means that these with the bottom incomes could have to decide on which primary must pay for.

Going into the autumn, slowdowns are anticipated first in companies most delicate to rates of interest, like development and manufacturing.

Andrew Wernick runs Industrial Plywood, a lumber provider in Studying, Pa., that raised wages considerably to compete for employees over the previous yr as demand for door frames and cupboards soared. Now, as rising mortgage charges drive down dwelling gross sales, he isn’t positive whether or not he’ll have the ability to preserve these new hires by way of the tip of the yr.

“Quite a lot of our prospects are nonetheless working off backlogs, and no new work is coming within the entrance door,” Mr. Wernick stated. “We’re not so fast to let folks go in the event that they’ve been skilled already — they’re so tough to interchange.”

Some industries that employed employees energetically — like these benefiting from a heavy demand for items in earlier phases of the pandemic — are coping with a swing again to extra typical shopping for patterns. For employees who responded to increased wages provided by determined employers, that may be painful.

Exhibit A is the trucking trade, which introduced in 1000’s of drivers as freight charges rose, and headlines proclaimed a labor scarcity. Kenny Vieth, the president of the transportation knowledge agency ACT Analysis, stated lowered spending on items meant not sufficient cargo to maintain everybody on the highway.

“Guys have been simply pouring into the market on the actual second when freight volumes rolled off,” Mr. Vieth stated. “Given how rapidly the spot market has collapsed, we’re projecting that the motive force capability reset goes to occur extra rapidly.”

Because the final two years have proven, unpredictable headwinds can all the time emerge — a brand new coronavirus variant, one other world battle or a pure catastrophe that throws provide chains again into turmoil.

The variable on most forecasters’ minds, nevertheless, is what toll the Fed’s interest-rate coverage will tackle financial exercise.

“I believe it’s inevitable that we’ll see a slowdown,” stated Cailin Birch, the lead U.S. analyst for the Economist Intelligence Unit. “The query is whether or not it’s a slowdown that’s manageable, or if it turns right into a collapse.”