The inventory market’s staggering run of losses got here to an finish final week, with the S&P 500 snapping a seven-week dropping streak and pulling away from the brink of a bear market with a 6.6 % bounce by way of Friday.

However the considerations that drove Wall Avenue’s panic this 12 months stay unresolved. It’s far too quickly to know if skyrocketing client costs have peaked, if the Federal Reserve has charted the best path for rates of interest, or how nicely the economic system will be capable of maintain up within the face of quick inflation and rising borrowing prices.

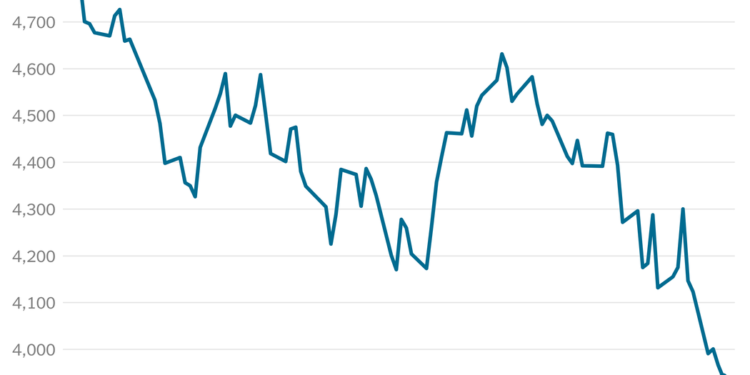

Till there’s readability on these points, analysts say, it will be a mistake to presume that this 12 months’s drop in shares was over. As share costs have tumbled, falling about 13 % since early January, predictions that the promoting has run its course have repeatedly turned out to be flawed, with the market altering route as every new piece of information on the economic system got here in. Final week’s bounce, as traders plowed some $20 billion into world inventory funds, may very well be one other short-lived rally.

“There’s no certainty, particularly within the quick time period,” mentioned Victoria Greene, chief funding officer at G Squared Personal Wealth, an funding adviser. “This may very well be a uneven summer time the place you’re going to have ups and downs and also you’re going to get jerked round.”

The latest features have been underpinned by some excellent news concerning the well being of American customers. A number of retailers, together with Macy’s and Nordstrom, reported better-than-expected quarterly outcomes, saying customers are keen to commerce up on their purchases as they begin to journey once more and return to places of work. On Friday, information from the federal government confirmed that People continued to spend in April, tapping into their financial savings to take action at the same time as they contended with increased prices.

Only a week earlier, studies from two retail giants — Walmart and Goal — had triggered the precise reverse response, elevating alarms that some customers had reached their restrict and that inflation was beginning to hit company income, too. That concern helped push the S&P 500 to its seventh consecutive weekly loss, the longest stretch of declines since 2001 after the dot-com bubble burst.

The combined studies converse to the way in which inflation is affecting the inhabitants in a different way, economists say, with lower-income People altering their habits in consequence. However additionally they level to one of many largest challenges traders have confronted as they’ve tried to regulate expectations: a consistently shifting image wherein debates appear to be settled someday solely to be resurrected the subsequent.

Not way back, the market’s rally was relentless, lifting shares of expertise giants like Apple, which in January was briefly value $3 trillion, the primary firm ever to achieve that lofty level. Even because the pandemic raged, the S&P 500 was pulled from one file to the subsequent, rising 90 % over three years by way of 2021.

These have been features fueled by near-zero rates of interest, slashed to that stage by the Fed in March 2020. The identical insurance policies, in addition to authorities stimulus spending, contributed to an increase in client demand for every thing from vehicles to electronics that helped ignite the inflation downside spooking traders in the present day.

With client costs rising at their quickest tempo in 40 years, the Fed has abruptly modified course, elevating rates of interest in March for the primary time because the pandemic started in an effort to chill the economic system. Russia’s invasion of Ukraine and new Covid-19 lockdowns in China additionally raised dangers to progress, the provision of meals and power, and the costs of products typically.

All of those components have led economists to slash their expectations for financial progress in the US. A survey from the Nationwide Affiliation for Enterprise Economics confirmed that forecasters count on gross home product to develop 1.8 percent in the fourth quarter from a 12 months earlier, down from their prediction in February of two.9 %.

Now, traders count on the Fed to lift its benchmark borrowing price to as excessive as 2 percent by July, an enormous bounce however not at all the final enhance anticipated this 12 months. Along with being a drag on the economic system, the upper borrowing prices imply traders have been compelled to rethink what they’re keen to pay for shares or different dangerous investments — and the best fliers have been hit hardest.

“The world is repricing for the tip of terribly low rates of interest and terribly accommodative financial coverage,” mentioned David Lefkowitz, head of equities for the Americas at UBS International Wealth Administration. “The losses really feel way more painful than the pleasure we acquired from seeing the features.”

All of the promoting might additionally have an effect on the actual economic system, as retirement nest eggs, school financial savings accounts or rainy-day funds lose worth and chief executives develop into much less keen to take dangers.

“Numerous wealth has been destroyed within the final 5 months,” mentioned Russ Koesterich, portfolio supervisor of the BlackRock International Allocation Fund. “That has an impact on company sentiment and hiring and investing plans by corporations. It additionally has an impact on client habits.”

For now, the inventory market has narrowly prevented falling right into a bear market, sometimes outlined as a 20 % decline from a latest excessive that signifies a extreme downturn in sentiment concerning the market and the economic system.

It got here shut on Could 20, although, briefly falling into that stage earlier than rallying by the tip of buying and selling. After final week’s bounce, the S&P 500 is 13.3 % under its Jan. 3 file — removed from bear market territory.

However there are different methods to measure unease amongst traders. One in all them is that huge swings in inventory costs are coming extra ceaselessly lately. Even when it’s simpler to abdomen a drop, final week’s acquire was a part of this volatility.

“That is volatility, too,” Steve Sosnick, a dealer and chief strategist at Interactive Brokers, mentioned of the week’s acquire. “That is what I wish to name socially acceptable volatility.”

There can be a clearer turning level, Mr. Sosnick mentioned, when traders determine the Fed is finished elevating charges.

“The Fed doesn’t essentially should be completed — individuals simply should understand they are going to be completed,” he mentioned. Figuring out when that can occur, although, is not possible at this level.