Welcome to Startups Weekly, a contemporary human-first tackle this week’s startup information and traits. To get this in your inbox, subscribe right here.

I’ve been pondering rather a lot about silos, or the shortage thereof, inside startupland. There’s typically a man-made wall that’s put up between firms at totally different levels of development, when in actuality, everyone seems to be in the identical room, clinking glasses and tripping over the identical rug.

Let me be extra exact. Because the late-stage market has cooled down for tech firms, many early-stage buyers say their portfolio firms aren’t too impacted as a result of they’re years away from an exit and have sufficient capital to climate uncertainty. The identical vitality was on show this week at Avisionews Early Stage. Stellation Capital’s Peter Boyce II coyly advised me that, primarily based on the time period sheet he wrote yesterday, we’re nonetheless undoubtedly in a founder-friendly market, whereas a pair of entrepreneurs not-so-subtly jogged my memory that experimental bets are nonetheless landing significant funding rounds.

I consider in optimism, and consider this time in early-stage startups as a recorrection, not a reckoning. However, new PitchBook and NVCA data does present that {dollars} are altering throughout the board.

For my full take, learn my Avisionews+ column: “Let’s cease pretending there are silos in startupland.” In the remainder of this article we’ll discuss social fintech, a brand new TC-1 on Kindbody and a few historical past about hostile takeovers. As all the time, you may assist me by forwarding this article to a pal, following me on Twitter or subscribing to my personal blog.

Deal of the week

I coated Braid, a social fintech play that desires to make shared wallets with associates extra mainstream. The startup lately launched a brand new twist on client fee hyperlinks: Individuals can arrange a Braid Pool round any effort — a fund for this summer time’s Italy journey, shared automobile gasoline bills, or a kitty to place towards month-to-month e book membership snacks — after which ship a hyperlink to associates who need to put money in. The cash then goes immediately into the pockets and the creator can both handle it solo or along with individuals.

Right here’s why it’s vital: Fintech can’t simply construct for the neatest, most pro-active particular person within the room, so I like that Braid is the center floor between the pal that’s all the time on high of splitting the invoice on the finish of dinner and the one who will get overwhelmed at calculating and dividing up the tip. Ahem, me. Sharing one thing as emotional as cash undoubtedly brings challenges — which I define in my piece — however it additionally begins an interesting dialog.

Honorable mentions:

Picture Credit: Olena Poliakevych (opens in a new window) / Getty Photographs

The Kindbody TC-1

Rae Witte dug into the story of Kindbody, a fertility startup that has raised $154.7 million in recognized enterprise capital up to now with a revolutionary take: it’s vital to make sufferers really feel heard, and comfy.

Right here’s why it’s vital: We all know that “holistic well being” is the time period du jour for digital well being firms, so there’s pure questions round if Kindbody’s tackle fertility assist is definitely impactful. This, from one of many tales, provides me hope:

Fertility sufferers have numerous wants, and their expertise on the portal displays that. An LGBTQ+ affected person received’t be requested the identical questions or be given the identical info as a heterosexual couple as a result of their fertility journey is biologically totally different. When sufferers enroll, they embrace how they determine and the companies they’re leveraging. This personalization continues all through sufferers’ journeys, each throughout visits and thru the portal.

Your entire collection:

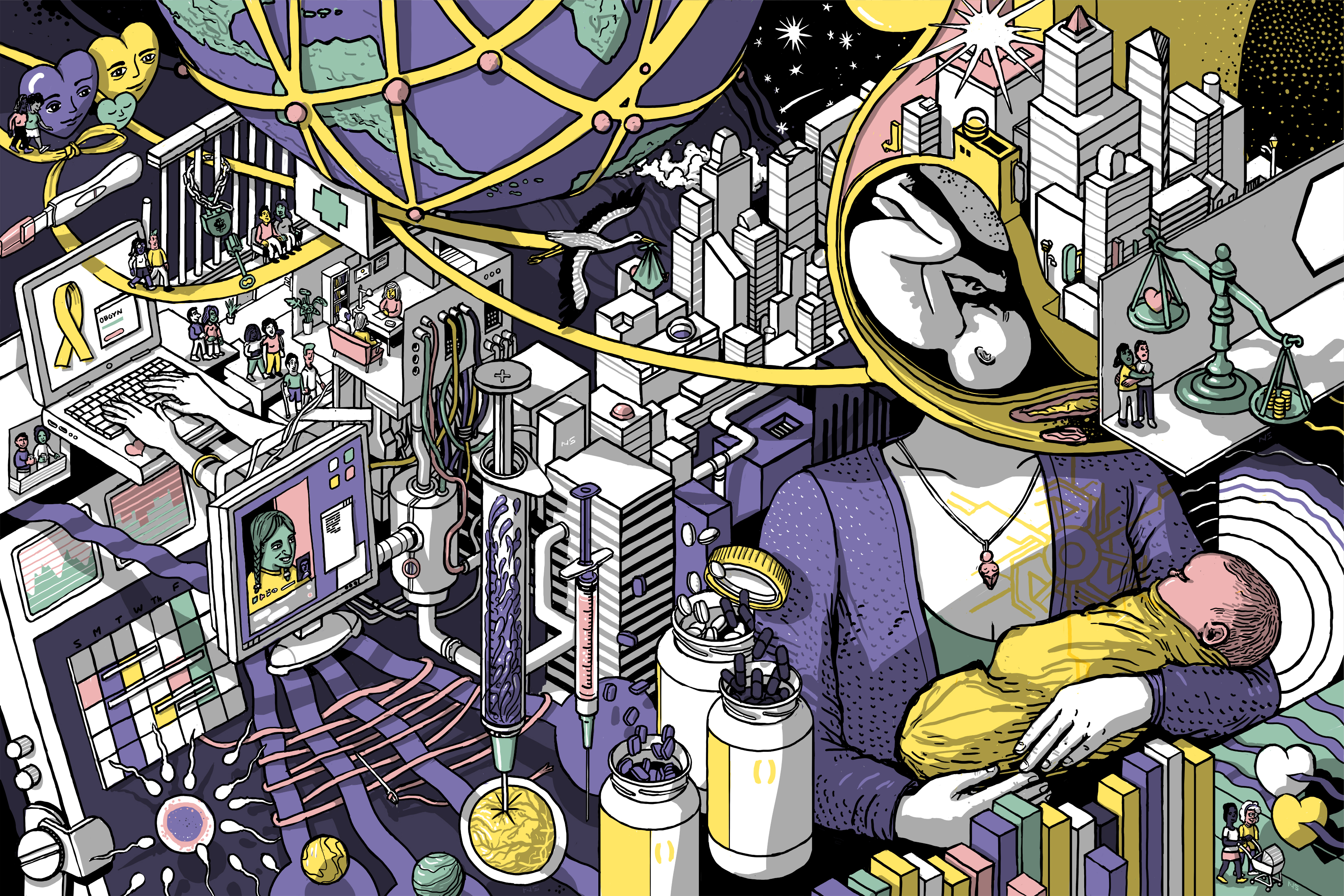

Picture Credit: Nigel Sussman

Hostile takeover, anyone?

Elon Musk made information, but once more, this week along with his fixation on Twitter. This time the billionaire supplied to purchase Twitter, which despatched share costs hovering and Avisionews digging into the historical past of hostile takeovers. Put merely, a hostile takeover occurs when an organization or particular person tries to take over one other firm towards the needs of the corporate’s administration. It’s spicy.

Right here’s why it’s vital: I imply, for anybody who’s following the Twitter and Musk saga, it’s vital to know how sensible it’s for a takeover to really occur. As Kyle Wiggers taught me in his piece, these takeovers are often doomed in a roundabout way, because of poison tablets, and energy balances.

When you’ve got no thought what I’m speaking about, take a minute:

Picture Credit: HANNIBAL HANSCHKE/POOL/AFP / Getty Photographs

Throughout the week

- Avisionews Early Stage 2022 was so rattling enjoyable. Because of everybody who attended, requested questions and mentioned hiya because it was really a thrill for the staff to fulfill readers in particular person after far too lengthy. In the event you missed the occasion, a recap of all panels will roll out on Avisionews+ over the subsequent few weeks so keep tuned.

- Snag tickets for subsequent month’s occasion: Avisionews Mobility, a two-day hybrid convention that includes high buyers, founders and thought leaders of the automotive trade.

- Lastly, if you happen to missed final week’s Startups Weekly, learn it right here: Crypto’s newest disruption could also be investor expectations and hearken to a podcast about it right here: Enterprise wants crypto greater than crypto wants enterprise.

Seen on Avisionews

Faraday Future demotes founder as administration shakeup continues

Lydia Hylton on why she joined Bain Capital Crypto regardless of ‘that tweet’

Windmill needs to tug window AC items, kicking and screaming, into 2022

SoftBank shifts LatAm plan with new early-stage spinout, Add Ventures

Over 14,000 Etsy sellers are happening strike to protest elevated transaction charges

Seen on Avisionews+

Is Stripe low cost at $95 billion?

Why EV startups ought to’ve hit the brakes earlier than merging with a SPAC

Expensive Sophie: I didn’t win the H-1B lottery. What are my subsequent steps?

An inside have a look at a Ukrainian fintech startup adapting to life throughout wartime

Mayfield’s Arvind Gupta discusses startup fundraising throughout a downturn

Till subsequent time,