It’s dawning on inventory traders that they had been incorrect in regards to the Federal Reserve.

After rallying behind a resilient financial system, slowing inflation and the hope that the central financial institution would finish its interest-rate will increase earlier than it had communicated, inventory buying and selling has grown jittery.

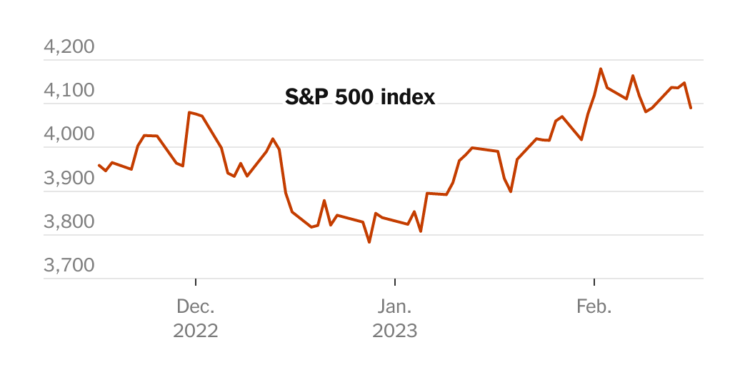

The S&P 500 has misplaced its momentum in February, after a drop this week that left it 2.4 % decrease than its peak early within the month. Shares have oscillated between positive aspects and losses as new financial knowledge have clouded the outlook for traders, marking a notable shift available in the market after shares jumped greater than 6 % in January.

The change in tone this week got here as a gradual stream of knowledge has proven the financial system continued to run scorching in January. Regardless of high-profile layoffs at massive know-how corporations like Meta and Microsoft, employers in the US continued to rent at a fast clip, shoppers stored spending and costs continued to rise briskly firstly of the yr throughout an array of products and companies.

All these knowledge factors counsel that the financial system retains vital vigor, even after a yr of fast coverage changes geared toward cooling down the financial system. Fed officers had repeatedly warned that there was extra work to do to gradual rising costs, however traders had hoped {that a} slowdown in inflation that took maintain in earnest late final yr would enable policymakers to hit pause on their fee changes earlier than they’d predicted. Now, mounting proof that the financial system stays surprisingly sturdy and value will increase unexpectedly cussed have begun undercutting that narrative.

In response, traders have sharply raised their expectations for the variety of instances the Fed will improve rates of interest within the coming months. And even central bankers themselves have begun to drift the likelihood that charges might want to climb greater than they beforehand anticipated if the financial system doesn’t calm down. Larger rates of interest increase prices for shoppers and firms, slowing demand and sometimes weighing on the inventory market.

Our Protection of the Funding World

The decline of the inventory and bond markets this yr has been painful, and it stays tough to foretell what’s in retailer for the longer term.

“I’m very damaging proper now on equities,” stated Eric Johnston, the top of fairness derivatives at Cantor Fitzgerald, who predicted the current S&P 500 rally however now expects a hunch. “I believe the transfer we now have seen within the fee market, a few of the inflation numbers which have come out and the expectation that the financial system shall be high quality is all pretty problematic.”

Mr. Johnston now thinks the S&P 500 will finally fall beneath its 2022 low, a drop of greater than 10 % from present ranges. Strategists at Morgan Stanley and JPMorgan Chase are additionally amongst these bracing for a fall.

Bond traders had been faster to shift their view.

At first of this month, traders betting on the trail of rates of interest predicted the Fed would increase its benchmark fee simply as soon as extra this yr, by 1 / 4 of a share level in March.

Now, these merchants are leaning to 3 will increase of that dimension, by means of July, which might take the Fed’s goal fee to a spread of 5.25 % to five.5 %. That’s above the Fed’s personal most up-to-date forecasts, printed in December.

However policymakers have additionally hinted that their very own estimates may very well be poised for revision if the financial system continues to run hotter than beforehand anticipated.

John C. Williams, president of the highly effective Federal Reserve Financial institution of New York, urged this week that charges had been more likely to rise to a spread of 5 % to five.5 % — barely above the 5 % to five.25 % median within the central financial institution’s December forecast. He and several other of his colleagues have stated they could have to do much more than that if consumption and the labor market stay so sturdy.

“With the power within the labor market, clearly there’s dangers that inflation stays greater for longer than anticipated or that we’d want to boost charges greater than that,” Mr. Williams informed reporters in New York this week.

Loretta Mester, the president of the Federal Reserve Financial institution of Cleveland, stated throughout a speech on Thursday that “we could very nicely have to maneuver greater, maintain it longer at that peak fee and even change what we do at any explicit assembly” if financial pressures stored inflation elevated.

Given current knowledge, economists at Goldman Sachs and Financial institution of America modified their forecasts on Thursday. They’re now predicting that the Fed would increase charges to five.25 % to five.5 % this yr — 1 / 4 level greater than both financial institution had beforehand estimated.

“The Fed may need to hike additional if inflation, job development and shopper demand refuse to melt,” Michael Gapen at Financial institution of America wrote in a analysis notice explaining the shift.

For traders, the potential of extra fee strikes has rekindled the worry that the Fed’s marketing campaign will push the financial system right into a downturn. It’s an about-face from the extra optimistic view that had taken maintain in monetary markets firstly of the yr, that inflation may fall whereas the financial system continued to develop.

“We had simply acquired comfy with what the Fed informed us it was going to do two weeks in the past, and already we’re having to rethink that,” David Donabedian, the chief funding officer of CIBC Personal Wealth US, stated, referring to the current Fed assembly. “The momentum available in the market has stopped.”